What's Hot: Did January Mark The Bottom For The DC-Area Housing Market? | The Roller Coaster Development Scene In Tenleytown and AU Park

Mortgages

Following are all UrbanTurf articles filed under Mortgages, from most recent to least.

Mortgage Delinquencies Rise for the First Time Since 2013

Nena Perry-Brown | February 16th 2017

Recent data suggests that the rise in mortgage rates has already had an impact on the housing market, causing an uptick in mortgage delinquencies in t... read»

Will Rising Mortgage Rates Repress Home Value Growth in 2017?

Nena Perry-Brown | February 10th 2017

Experts expect that rising mortgage interest rates, likely to reach 4.75-5 percent by the end of the year, will have the largest impact on mortgage af... read»

Federally-Backed Mortgage Loan Limits to Rise for the First Time in Over a Decade

Nena Perry-Brown | November 28th 2016

In some "high cost" counties, such as those in the DC metro area, the loan limit is already higher than what is typical nationwide and will increase f... read»

Get the (free) newsletter:

Get the (free) newsletter:

More House for Less Money: The Lending Market Loosens Up

Lark Turner | March 18th 2015

For a smaller down payment, buyers today can get a larger house than they could a few years ago.... read»

Report: Half of New Homebuyers Don't Shop Around for Mortgages

Lark Turner | January 14th 2015

Forty-seven percent only seriously consider one mortgage lender.... read»

Freddie Mac Launches 3% Down Payment Mortgage Product

Lark Turner | December 9th 2014

Home Possible Advantage is for low- and moderate-income buyers making no more than 100 percent of the area median income.... read»

Starting Today It Will Be Easier to Get a Mortgage

Lark Turner | December 1st 2014

New guidelines from Fannie Mae and Freddie Mac that go into effect December 1 relax the standards that lenders have been using to approve mortgages.... read»

FHFA to Loosen Rules on Mortgages, Offer Lower Down Payment Options

Lark Turner | October 21st 2014

The government hopes to give more first-time buyers and low-to-middle income earners a better chance at a house.... read»

Most Popular... This Week • Last 30 Days • Ever

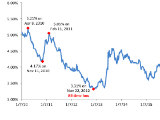

As mortgage rates have more than doubled from their historic lows over the last coupl... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

The longtime political strategist and pollster who has advised everyone from Presiden... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

A report out today finds early signs that the spring could be a busy market.... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro