What's Hot: A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

Will Rising Mortgage Rates Repress Home Value Growth in 2017?

Will Rising Mortgage Rates Repress Home Value Growth in 2017?

✉️ Want to forward this article? Click here.

The path of rates since 2010.

In the years following the nationwide recession, interest rates fell to their lowest level on record, helping to support the recovery of the housing market.

Now, experts expect rates to rise back to 4.75-5 percent by the end of the year, having a larger impact on mortgage affordability and home value growth than any other factor in 2017.

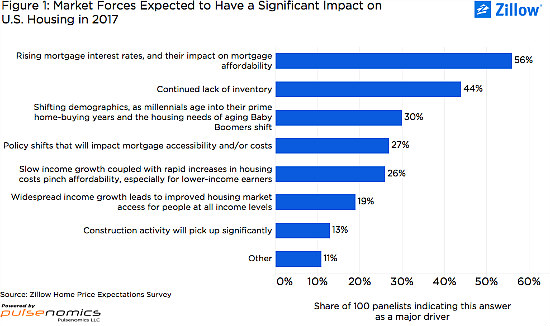

When responding to the latest Zillow Home Price Expectations Survey, 56 percent of panelists surveyed cited “rising mortgage interest rates, and their impact on mortgage affordability” as the most significant market force that will effect the housing market this year.

“Lately, rates have begun rising again, largely in response to the Federal Reserve’s decision to raise the federal funds rate – which influences the mortgage rates offered by home lenders – for just the second time in a decade, with promises of similar hikes to come throughout 2017,” the report notes.

story continues below

loading...story continues above

While rates are increasing, they remain quite low by historical standards. Mortgage interest rates averaged closer to 8 percent between 1980-2000. As mortgages become less affordable, however, homeowners will be less likely to trade up to a larger or more valuable home, further exacerbating an already supply-constrained market.

“Rather than moving up, in a higher interest rate environment, many buyers may find that a home similar to the one they’re already living in – let alone larger or more expensive – would actually be less affordable than the one they currently own,” the report finds.

Meanwhile, median home values nationwide are expected to grow by 4.4 percent (year-over-year) in 2017, or by roughly 17.3 percent through 2021. “On average, experts said rates on a 30-year, fixed mortgage will need to reach 5.65 percent before significantly impacting home value growth, though a sizable share said rates of 5 percent or lower will have an impact,” the report states.

The median nationwide price of a house peaked almost exactly a decade ago at $196,600 on the cusp of the Great Recession; this price point is expected to be surpassed by this April.

See other articles related to: home buying, home values, mortgage rates, mortgages, zillow

This article originally published at https://dc.urbanturf.com/articles/blog/rising_mortgage_rates_expected_to_repress_home_value_growth/12191.

Most Popular... This Week • Last 30 Days • Ever

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

Chris Hughes and husband Sean Eldridge are putting their Kalorama home on the market ... read »

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- Facebook Co-founder Lists DC Home For Sale

- One of DC's Oldest Homes Is Hitting the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro