What's Hot: The 4 Projects in the Works Near DC's Starburst Intersection | A 153-Room Aloft Hotel Pitched For Mt. Vernon Triangle

Mortgage Delinquencies Rise for the First Time Since 2013

Mortgage Delinquencies Rise for the First Time Since 2013

Last week, UrbanTurf asked how rising mortgage rates might effect the housing market, especially where home value growth and mortgage affordability are concerned. Now, recent data suggests that the rise in rates has already impacted the market, specifically causing an uptick in mortgage delinquencies.

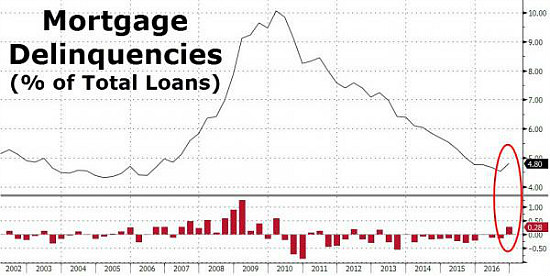

Mortgage delinquency rates quarter by quarter

According to Zero Hedge, mortgage delinquencies increased as a share of total mortgages quarter-over-quarter in the fourth quarter of 2016 for the first time since 2013.

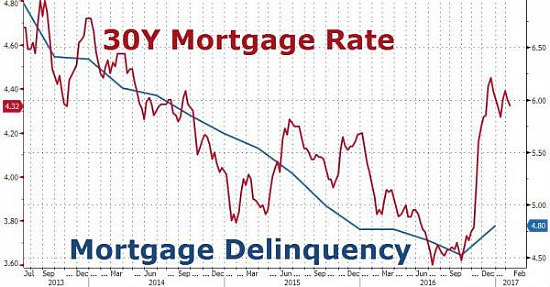

Mortgage rates relative to delinquency rates

Delinquencies went from being 4.52 percent of all mortgages in Q3 to 4.8 percent in Q4. This jump occurred just as 30-year mortgage rates rose to 4.32 percent in the first quarter of 2017; mortgage rates are expected to rise to between 4.75-5 percent by the end of the year.

See other articles related to: mortgage rates, mortgages

This article originally published at https://dc.urbanturf.com/articles/blog/q4_2016_mortgage_delinquencies_up_for_the_first_time_since_2013/12224.

Most Popular... This Week • Last 30 Days • Ever

In this article, UrbanTurf looks at the estimated annual maintenance costs associated... read »

Another concept has been unveiled for one of DC's most contentious development sites,... read »

The residential development in the works along Florida Avenue NE is looking to increa... read »

Renter demand has continued to push Class A apartment rents in the DC region up this ... read »

The big news in the development pipeline east of DC's H Street Corridor is the resur... read »

- What Are the Annual Maintenance Costs When You Own a Home?

- A First Look At The New Plans For Adams Morgan's SunTrust Plaza

- 46 to 48: The Biggest Project In Trinidad Looks To Get Bigger

- How Much Did DC-Area Rents Rise At The Beginning of 2024?

- The 4 Projects In The Works Near DC's Starburst Intersection

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro