What's Hot: Did January Mark The Bottom For The DC-Area Housing Market? | The Roller Coaster Development Scene In Tenleytown and AU Park

Why More Millennials Aren't Homeowners

Why More Millennials Aren't Homeowners

✉️ Want to forward this article? Click here.

Although the millennial cohort represented a sizeable share of first-time homebuyers in the second quarter of this year, it is well-documented that the generation born between 1981 and 1997 has not been purchasing homes at the same rate seen in prior generations. Homeownership and household formation have long been seen as a hallmark of adulthood, yet less than a third of millennials own homes. A new study from Urban Institute examines not only why this is, but also whether, given the same circumstances as previous generations, millennial homeownership would be more prevalent.

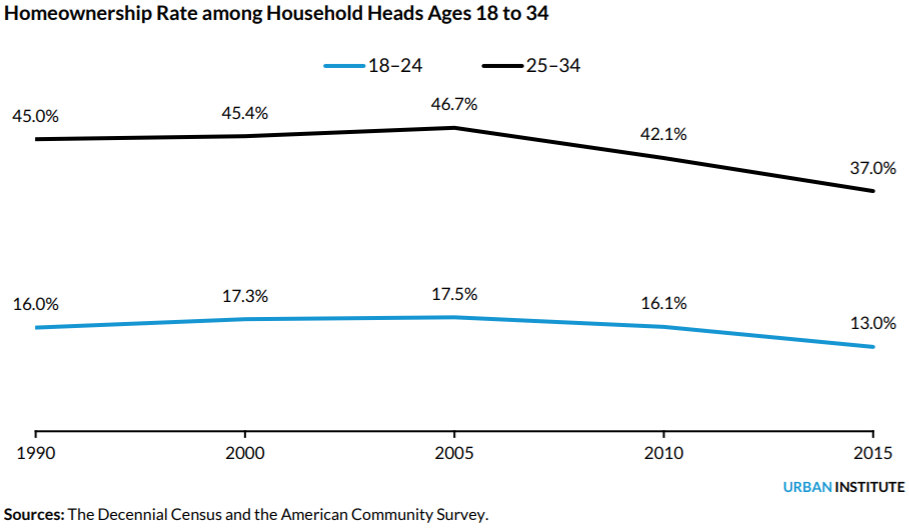

The study identifies 32 percent of 18-34 year olds as homeowners, making them less likely to be homeowners compared to Gen Xers and baby boomers. Several factors can be attributed to this disparity, although some variables have more bearing on homeownership rates than others. With the latest examination of 2015 data, the authors of this study control for those factors to see whether millennials would own homes at greater rates given the same circumstances as prior generations (baby boomers in 1990 or Gen Xers in 2000). Some of those findings are below:

- Demographics: The millennial generation has a greater share of non-white households than prior generations, and due to persistent redlining and the impact of other systemic barriers that have either undermined or outright denied their ability to own homes, this sector tends to own homes at a rate 15 percent lower than white households. This is particularly salient because having homeowner parents is a reliable predictor of being a homeowner. However, this demographic shift isn't a substantial cause of disparate generational homeownership: if the demographics were the same as in 1990, the millennial homeownership rate would only be 34.8 percent, and in 1990, 39 percent of 18-34 year olds were homeowners.

- Educational Attainment and Debt: The millennial generation has a higher proportion of college-educated individuals, which typically leads to a higher rate of homeownership. However, the share of millennials carrying student loan debt is 45.6 percent, 10 percent higher than Gen Xers and more than 25 percent higher than baby boomers. "The Federal Reserve Bank of New York shows that the average education debt for 25-year-olds has increased from $4,516 in 2003 to $10,033 in 2015," the report states. "Thus, even though more education is usually correlated to higher likelihood of homeownership, the cost of education has risen so substantially that it affects millennials’ ability to buy a home."

story continues below

loading...story continues above

In this way, the impact of educational attainment is counteracted by an increased debt load, creating a lower rate of millennial homeownership even if the educational attainment distribution was the same as that of prior generations: 31.3 percent or 30.3 percent of millennials would be homeowners given respective 1990 or 2000 attainment levels.

- Marital Rate: The millennial generation is foregoing or delaying marriage compared to previous generations, with 38.5 percent of 18-34 year olds married now vs. 52.3 percent of 18-34 year olds married in 1990. Marriage increases the chance of being a homeowner by 18 percent. If the marriage rate was the same in 2015 as it was in 1990, 37 percent of millennials would be homeowners.

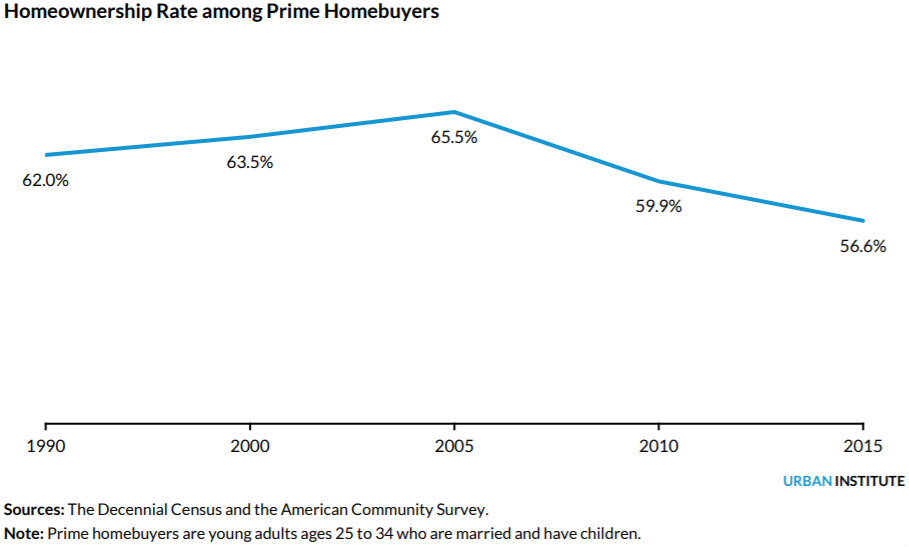

The study also asked whether, after having witnessed the impact of the recession on the wealth-building power of homeownership, millennials simply have a different attitude toward purchasing a home than previous generations. In order to determine this, the study isolated the homeownership rates of millennials who qualify as "prime households", meaning those aged 25-34 and married with children who are therefore ideally poised to be homeowners.

Among those households, homeownership has dropped over time, from 62 percent and 63.5 percent in 1990 and 2000, respectively, to 56.6 percent in 2015. This indicates that despite there being seemingly no reason for these would-be buyers to purchase a home, they are still more hesitant to make that purchase just because they could.

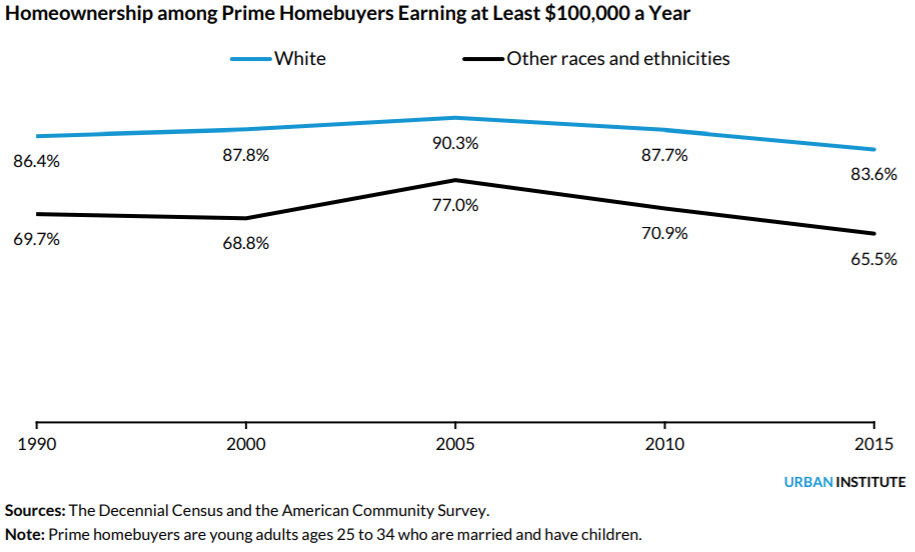

When focusing on prime households that bring in at least a six-figure annual income, 83.6 percent of white prime households were homeowners in 2015, a drop-off of less than 3 percent since 1990. For non-white households, 65.5 percent of prime households earning at least $100,000 were homeowners, a 4 percent drop from 1990. Even among high-earning prime households, non-white would-be homebuyers seem to have been more dramatically impacted by the recession, experiencing a nearly 12 percent drop in the homeownership rate from the 2005 peak compared to a nearly 6 percent drop in the homeownership rate among white would-be homebuyers.

The Urban Institute offers several recommendations to help increase the rate of homeownership among millennials, including more prevalent and accessible financial literacy training and streamlining the mortgage process. With a homebuilding company offering student loan forgiveness and Freddie Mac looking at ways to help those who engage in the gig-sharing economy to utilize nontraditional income sources to aid in home purchases, it is clear that creative approaches to increasing millennial homeownership could become a necessity.

Note: As first published, this article neglected to contextualize the disparate homeownership rates between white and non-white households. The Demographic section of the article has since been updated to correct this oversight.

This article originally published at https://dc.urbanturf.com/articles/blog/why-more-millennials-arent-homeowners/14220.

Most Popular... This Week • Last 30 Days • Ever

As mortgage rates have more than doubled from their historic lows over the last coupl... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

The longtime political strategist and pollster who has advised everyone from Presiden... read »

A report out today finds early signs that the spring could be a busy market.... read »

A potential collapse on 14th Street; Zuckerberg pays big in Florida; and how the mark... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro