What's Hot: The Last Piece of Potomac Yard: Mill Creek Residential Pitches 398-Unit Apartment Building

What is an Assumable Mortgage?

What is an Assumable Mortgage?

✉️ Want to forward this article? Click here.

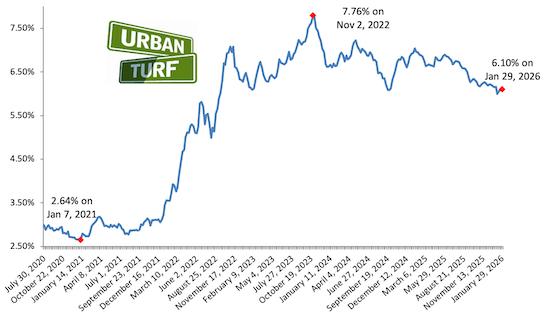

An assumable mortgage is a type of home loan that allows a homebuyer to take over the seller’s existing loan under the same terms, rather than obtaining a new mortgage. This can be appealing in an environment where interest rates are high, and the home seller has a much lower rate on their mortgage. However, assumable mortgages come with their own set of considerations, benefits, and limitations, which are important to understand whether you are a buyer or a seller.

How Assumable Mortgages Work

When a mortgage is assumable, it means that the terms of the mortgage—such as the interest rate, remaining loan balance, and repayment period—can be transferred from a homeowner to a buyer. The process typically involves the buyer qualifying for the loan, just as they would for a new mortgage, except that the terms of the existing mortgage remain unchanged.

Not all mortgages are assumable. Whether a mortgage can be assumed depends on the terms of the original loan and the policies of the lender. Generally, loans insured by the Federal Housing Administration (FHA), U.S. Department of Veterans Affairs (VA), and U.S. Department of Agriculture (USDA) are assumable, while conventional loans are less likely to be.

story continues below

loading...story continues above

The Good Side of Assumable Mortgages

Buyers:

- Lower Interest Rate: If current market rates are higher than the rate on the seller’s mortgage, the buyer can save significantly on interest costs over the life of the loan.

- Reduced Closing Costs: Assuming a mortgage may involve lower closing costs compared to originating a new mortgage.

- Simpler Financing Process: While the buyer still needs to qualify, the process may be streamlined compared to obtaining a new mortgage.

Sellers:

- Increased Marketability: In a high-interest rate environment, offering an assumable mortgage can make a home more attractive to potential buyers.

- Faster Sale: The potential savings and benefits for buyers can lead to a quicker sale.

The Tougher Side of Assumable Mortgages

Buyers:

- Qualification Requirements: Buyers must qualify based on their creditworthiness and income, similar to a new loan application.

- Equity and Down Payment: Buyers typically need to pay the seller the difference between the purchase price and the remaining loan balance, which can be substantial if the home has appreciated in value.

- Lender Approval: Not all lenders will allow their mortgages to be assumed, and even if they do, they may impose conditions.

Sellers:

- Liability: If the mortgage is not properly assumed, the seller could remain liable for the debt.

- Lender Restrictions: Some lenders may not permit loan assumption or may require a fee to do so.

Assumable mortgages can provide financial benefits in the right circumstances but require careful consideration of the qualifications, terms, and potential risks involved. It is important to consult with real estate professionals and lenders to ensure that an assumable mortgage aligns with your financial goals and situation.

See other articles related to: assumable mortgages

This article originally published at https://dc.urbanturf.com/articles/blog/what_is_an_assumable_mortgage/21935.

Most Popular... This Week • Last 30 Days • Ever

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

The plan to replace the longtime home of Dance Loft on 14th Street with a mixed-use ... read »

The plans for a building that (forgive us) is just trying to fit in in downtown Bethe... read »

The developer is under contract to purchase Land Bay C-West, one of the last unbuilt ... read »

Even with over 1,100 new apartments delivering in the last 18 months, the new develop... read »

- One of DC's Oldest Homes Is Hitting the Market

- Plans For 101 Apartments, New Dance Loft On 14th Street To Be Delayed

- Narrow 260-Unit Apartment Building Pitched For Bethesda Moves Forward

- The Last Piece of Potomac Yard: Mill Creek Residential Pitches 398-Unit Apartment Building

- The Nearly 2,000 Units Still In The Works At Buzzard Point

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro