Here's What's Driving Mortgage Rates Down

Here's What's Driving Mortgage Rates Down

✉️ Want to forward this article? Click here.

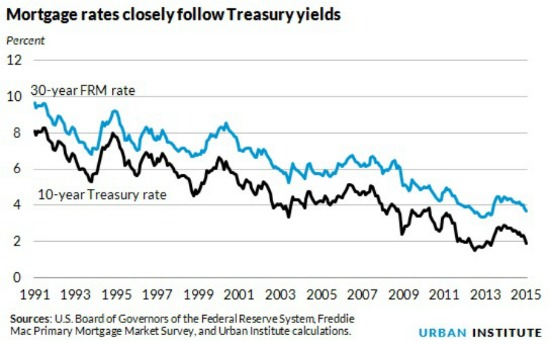

Mortgage rates, despite slight fluctuations, have stayed low for many months, an unexpected trend given the slowly but steadily improving economy. So what gives? The Urban Institute broke it down in a post on Thursday.

The think tank’s explanation looks at five major reasons why rates haven’t risen as predicted. The whole post is worth a look, but here’s a quick summary for the five reasons:

- The Institute suggests that a slowly growing and unsteady overseas economy is making the U.S. an attractive option for parking lots of money, meaning Treasury debts are sinking. Mortgage rates stay low as a result.

- Lots of oil market movement. This, the think tank argues, keeps uncertainty high. That contributes to the same phenomenon: people parking money in the U.S.

- A steadily improving U.S. economy means “the uncertainty premium that is normally reflected in higher interest rates for longer term debt is small, and reduced from a year ago.” Eventually, though, this will push rates up, which is why so many have predicted rates will start rising soon.

- Low treasury rates. These rates basically set mortgage rates. When they’re low, so are mortgage rates. And right now, they’re really low.

- A low number of mortgages. Getting a mortgage is still relatively difficult thanks to high credit standards, the think tank points out. Relatively low demand keeps interest rates enticing for buyers.

See other articles related to: mortgage rates, urban institute

This article originally published at https://dc.urbanturf.com/articles/blog/urban_institute_heres_whats_driving_mortgage_rates/9533.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

Only a few large developments are still in the works along 14th Street, a corridor th... read »

A soccer stadium in Baltimore; the 101 on smart home cameras; and the epic fail of th... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro