Here's What's Driving Mortgage Rates Down

Here's What's Driving Mortgage Rates Down

✉️ Want to forward this article? Click here.

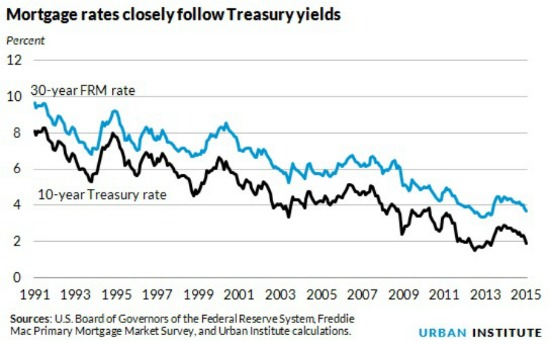

Mortgage rates, despite slight fluctuations, have stayed low for many months, an unexpected trend given the slowly but steadily improving economy. So what gives? The Urban Institute broke it down in a post on Thursday.

The think tank’s explanation looks at five major reasons why rates haven’t risen as predicted. The whole post is worth a look, but here’s a quick summary for the five reasons:

- The Institute suggests that a slowly growing and unsteady overseas economy is making the U.S. an attractive option for parking lots of money, meaning Treasury debts are sinking. Mortgage rates stay low as a result.

- Lots of oil market movement. This, the think tank argues, keeps uncertainty high. That contributes to the same phenomenon: people parking money in the U.S.

- A steadily improving U.S. economy means “the uncertainty premium that is normally reflected in higher interest rates for longer term debt is small, and reduced from a year ago.” Eventually, though, this will push rates up, which is why so many have predicted rates will start rising soon.

- Low treasury rates. These rates basically set mortgage rates. When they’re low, so are mortgage rates. And right now, they’re really low.

- A low number of mortgages. Getting a mortgage is still relatively difficult thanks to high credit standards, the think tank points out. Relatively low demand keeps interest rates enticing for buyers.

See other articles related to: mortgage rates, urban institute

This article originally published at https://dc.urbanturf.com/articles/blog/urban_institute_heres_whats_driving_mortgage_rates/9533.

Most Popular... This Week • Last 30 Days • Ever

While condo fees are often predictable, there are instances when they may need to be ... read »

The Pinkard Group has filed plans with Montgomery County for a 450-unit conversion al... read »

On Thursday, the Zoning Commission will consider text amendments aimed at making it e... read »

The Commanders and architecture and design firm HKS have unveiled new images for the ... read »

While the buildings at The Wharf are generally all finished, there are still a couple... read »

- How Do Condo Buildings Determine When Condo Fees Need to Be Increased

- A 26-Story Residential Tower Pitched For Middle Of Downtown Bethesda

- The Decision That Could Lead To More Alley Homes In DC May Be Coming Next Week

- New Renderings Unveiled Of 65,000-Seat Washington Commanders Stadium

- The Two Developments Still On The Boards Around The Wharf

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro