The Cost of Buying, Revisited

The Cost of Buying, Revisited

✉️ Want to forward this article? Click here.

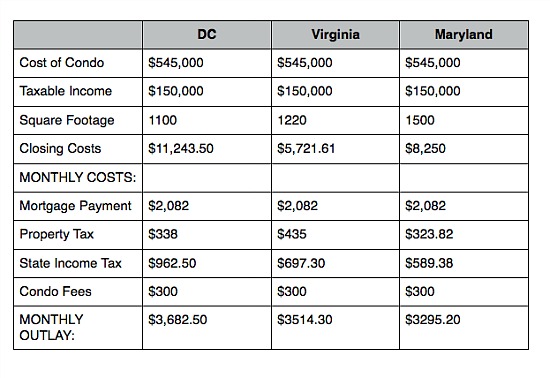

Earlier this month, we took a stab at calculating the difference in monthly costs associated with buying a $545,000 condo in DC versus Virginia. Based on the requests of a few commenters, we’ve decided to revisit the comparison (using the same married couple), this time folding in Maryland and adding a couple more cost considerations.

We added a column for Maryland, assuming a condo in North Bethesda, which joins the unit in Clarendon and the one in DC. For the sake of our comparison, we still assumed a 20 percent down payment with an interest rate of 4 percent over 30 years, although we recognize that loans above $417,000, known as high balance loans, usually come with slightly higher interest rates. We calculated the closing costs using Federal Title’s Quick Quote calculator (this number may vary from title company to title company). Our income tax rates came from here, our property tax information for Virginia from here, for DC from here, and for Maryland from here. We also took into account the Homestead Exemption for DC residents, which lowers the assessed value of the home by $67,500 for tax purposes.

Our “Taxable Income” line exists for the purpose of comparing the different state income tax rates. Of course, taxes are complicated and your own taxes will differ depending in deductions, dependents and other factors.

It appears that DC is the most expensive place to buy while you get the most bang for your buck in Maryland. However, some real estate agents believe that condos appreciate quicker and are more likely to hold their value in DC than in Maryland or Virginia, which may justify the extra cost of buying in DC. Also, lenders tell us that it is cheaper to refinance in DC than in Virginia. A few other factors would change the monthly costs, like differing insurance rates, city taxes (like Takoma Park’s), Virginia’s car tax, and the cost of commuting, so use this as an introductory, but handy starting point for comparisons.

Commenters, what other factors could we add to this chart?

See other articles related to: arlington condo buyers, bethesda condo buyers, cost comparison, dc condos, dc versus arlington, dclofts

This article originally published at https://dc.urbanturf.com/articles/blog/the_cost_of_buying_revisited/5281.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

A new proposal is on the boards for the former home of the Transportation Security Ad... read »

The developer is under contract to purchase Land Bay C-West, one of the last unbuilt ... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- 637 Apartments, 31,000 Square Feet Of Retail: The New Plans for Pentagon City TSA Site

- The Last Piece of Potomac Yard: Mill Creek Residential Pitches 398-Unit Apartment Building

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro