The Cost of Buying: Comparing Condo Purchases in DC vs. Arlington

The Cost of Buying: Comparing Condo Purchases in DC vs. Arlington

✉️ Want to forward this article? Click here.

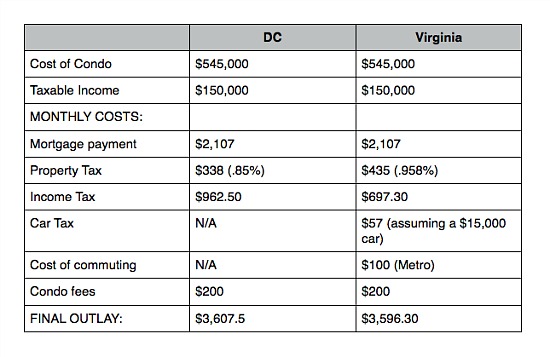

Recently, UrbanTurf reader Navid Choudhury came to us with an intriguing request: help him determine the cost-of-living difference between buying a condo in DC versus Virginia. Choudhury was concerned that the significant difference in income tax (DC’s rate is 2.75% higher than Virginia) would make a big difference in his monthly budget. He was also weighing a few other variables, like the cost of food, owning a car, and property taxes.

So, we narrowed down the circumstances and went about crunching the numbers.

For our calculations, we compared two married couples living in two-bedroom condos, one in Clarendon and one in DC. We assumed that both offered a 20 percent down payment, and that the DC residents will live in walking or bicycling distance of work. Our income tax rates came from here, our property tax information for Virginia from here, and for DC from here. We also took into account the Homestead Exemption for DC residents, which lowers the assessed value of the home by $67,500 for tax purposes.

Here is what we found:

All told, it looks like a difference of about $10 a month. However, if we were to factor in bus and Metro transportation in DC, that would add $70-$80 in commuting costs, making DC more expensive. (We also didn’t consider that state income tax may be deducted from federal tax returns.) There are a couple other factors that would impact the final number, like differing insurance rates and the higher restaurant tax in DC. But for these hypothetical couples, the budget almost balances out.

See other articles related to: arlington, arlington condo prices, cost comparison, dc condo prices, dc versus arlington, dclofts

This article originally published at https://dc.urbanturf.com/articles/blog/the_cost_of_buying_comparing_life_with_a_condo_in_dc_vs._clarendon/5218.

Most Popular... This Week • Last 30 Days • Ever

UrbanTurf takes a look at the options DC homeowners and residents have to take advant... read »

A major new residential development is on the boards for a series of properties near ... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The building is the second proposal for a pair of aging office buildings in downtown ... read »

The central action before the Board is a rezoning request for the nearly 36-acre site... read »

- A Solar Panel Primer for DC Residents

- 29-Story, 420-Unit Development Pitched For Middle Of Downtown Bethesda

- How DC's Population Changed During And After The Pandemic

- Fitting In: A Narrow 260-Unit Apartment Building Pitched For Bethesda

- Arlington County To Weigh Major Actions Advancing RiverHouse Redevelopment

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro