What's Hot: 142-Unit Development At Inn of Rosslyn Site Moves Forward | Mortgage Rates Inch Closer To 7%

First-Timer Primer: The Escalation Clause

First-Timer Primer: The Escalation Clause

✉️ Want to forward this article? Click here.

To help home buyers and sellers both novice and seasoned, UrbanTurf is running a series of primer articles this week about the buying and selling process.

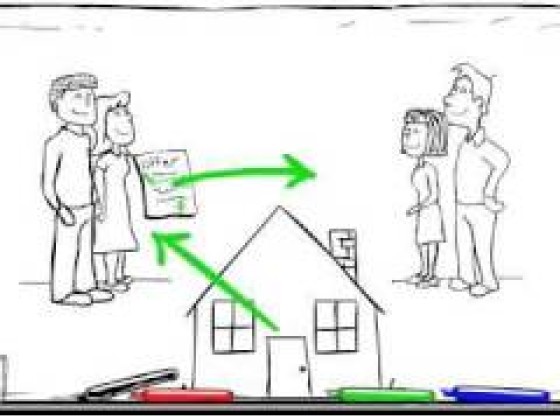

In a competitive housing market, bidding wars can be a common occurrence. In order to compete in this climate, potential homebuyers are adding escalation clauses so that their offers are as competitive as possible.

What is it, and how does it work?

An escalation clause is an optional part of an offer stating the buyer will increase their offer by X amount over a higher bid — but usually no higher than a stated amount. The clause is only triggered by a competing offer. Here's an example: If Buyer 1 puts in an offer of $500,000 on a home priced at $499,000, and Buyer 2 offers $501,000, Buyer 2 should get the house, right? Well, not if Buyer 1 has an escalation clause increasing her offer to $1,000 above the highest bidder up to a cap of $510,000. In the aforementioned case, Buyer 1 would get the house for $502,000. An escalation clause can move up in various increments, usually ranging from $1,000 to $3,500.

story continues below

loading...story continues above

How does this work with loans?

So how does an escalation clause work with financing? Let's say you put in an offer with a 25 percent down payment, so you are getting a loan of 75 percent of the purchase price from the bank. If an offer with an escalation clause ends up being the winning offer, that loan can be dealt with in one of three ways:

- No changes are made to the loan, and the buyer makes up the difference in cash.

- The loan automatically applies to the new amount, assuming that the borrower is approved for 75 percent of the final sales price.

- The loan covers some of the difference between the asking price and final sales price, and the buyer will pay the difference between the loan and the purchase price at settlement.

Other tips to remember

- Get proof that there's a higher offer. This would generally be a copy of the other offer with names and personal details redacted for privacy.

- Don't let your money get away from you. As always, make sure that the maximum price in your escalation clause is really something you're able to pay.

Similar Posts:

- First Timer Primer: How Much Cash Do You Need to Buy a House?

- First-Timer Primer: The Mortgage Pre-Approval Process

- First-Timer Primer: How Do Mortgage Payments Work?

- First-Timer Primer: A Condo Fee Tutorial

See other articles related to: escalation clause

This article originally published at https://dc.urbanturf.com/articles/blog/the-escalation-clause/15128.

Most Popular... This Week • Last 30 Days • Ever

Estate taxes, also known as inheritance taxes or death duties, are taxes imposed on t... read »

The application may signal movement on the massive mixed-use project.... read »

Buffett called the five-bedroom listing home when his father, Howard Buffett, was ser... read »

Penzance has unveiled its striking new plans for Rosslyn.... read »

A new report finds that the current housing market is split into two groups.... read »

- What Are Estate Taxes and How Do They Work?

- Raze Application Filed For Site Of 900-Unit Development, Food Hall Along Anacostia River

- The Oracle of Spring Valley: Warren Buffett's Childhood Home in DC Hits the Market

- Three Buildings, 862 Units: The New Plans For Rosslyn's Skyline

- The Two Housing Markets

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro