What's Hot: Douglas Development Files PUD For Large Warehouse At New City Site Along New York Avenue

The Difference a Year Makes in Interest Rates

The Difference a Year Makes in Interest Rates

✉️ Want to forward this article? Click here.

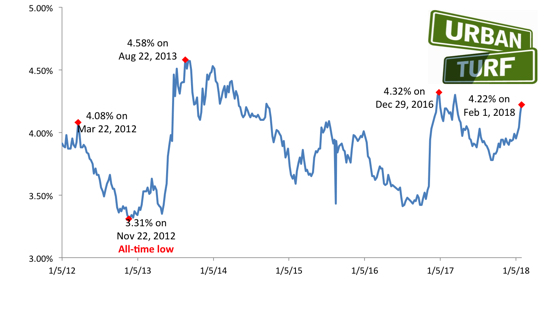

Long-term mortgage rates have essentially been doing one thing in 2018: going up. Still, if you look back a year, things haven't changed all that much.

One year ago, the average on a 30-year fixed-rate mortgage was 4.19 percent. Last week, Freddie Mac reported 4.22 percent as the average on this type of loan. So, how does that change in rates impact your mortgage payments?

Well, the short answer is not a whole lot, but to get a sense, UrbanTurf took a home with a $600,000 purchase price and assumed a buyer has excellent credit. Using the current rates and rates from last year, we examined how monthly mortgage payments changed. In each case, we assumed the buyer put down a 20 percent down payment. Note that these include principal and interest, but not the cost of insurance or taxes.

story continues below

loading...story continues above

Here are the two scenarios:

February 2017: The average mortgage rate was 4.19 percent.

Monthly mortgage payment: $2,344

Total outlay on mortgage (monthly payment x 360 months): $844,013

March 2017: The average mortgage rate is 4.22 percent.

Monthly mortgage payment: $2,353

Total outlay on mortgage (monthly payment x 360 months): $847,040

So, the difference between a rate of 4.19 percent and 4.22 percent at this price point is just about $9 a month, so don't fret about rising rates just yet.

This article originally published at https://dc.urbanturf.com/articles/blog/the-difference-a-year-makes-in-interest-rates/13541.

Most Popular... This Week • Last 30 Days • Ever

When you buy a home in the District, you will have to pay property taxes along with y... read »

The largest condominium building in downtown DC in recent memory is currently under c... read »

The plan to convert a Dupont Circle office building into a residential development ap... read »

The Rivière includes just 20 homes located on the eastern banks of the Anacostia Riv... read »

Why Tyra Banks is serving ice cream in DC; a bike shop/record store opens in Adams Mo... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro