What's Hot: A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

The Difference a Year Makes in Interest Rates

The Difference a Year Makes in Interest Rates

✉️ Want to forward this article? Click here.

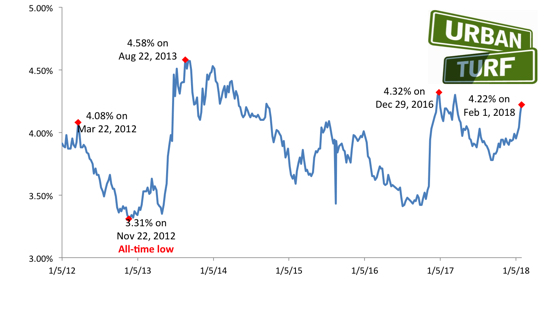

Long-term mortgage rates have essentially been doing one thing in 2018: going up. Still, if you look back a year, things haven't changed all that much.

One year ago, the average on a 30-year fixed-rate mortgage was 4.19 percent. Last week, Freddie Mac reported 4.22 percent as the average on this type of loan. So, how does that change in rates impact your mortgage payments?

Well, the short answer is not a whole lot, but to get a sense, UrbanTurf took a home with a $600,000 purchase price and assumed a buyer has excellent credit. Using the current rates and rates from last year, we examined how monthly mortgage payments changed. In each case, we assumed the buyer put down a 20 percent down payment. Note that these include principal and interest, but not the cost of insurance or taxes.

story continues below

loading...story continues above

Here are the two scenarios:

February 2017: The average mortgage rate was 4.19 percent.

Monthly mortgage payment: $2,344

Total outlay on mortgage (monthly payment x 360 months): $844,013

March 2017: The average mortgage rate is 4.22 percent.

Monthly mortgage payment: $2,353

Total outlay on mortgage (monthly payment x 360 months): $847,040

So, the difference between a rate of 4.19 percent and 4.22 percent at this price point is just about $9 a month, so don't fret about rising rates just yet.

This article originally published at https://dc.urbanturf.com/articles/blog/the-difference-a-year-makes-in-interest-rates/13541.

Most Popular... This Week • Last 30 Days • Ever

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

Chris Hughes and husband Sean Eldridge are putting their Kalorama home on the market ... read »

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- Facebook Co-founder Lists DC Home For Sale

- One of DC's Oldest Homes Is Hitting the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro