What's Hot: Did January Mark The Bottom For The DC-Area Housing Market? | The Roller Coaster Development Scene In Tenleytown and AU Park

From a $350,000 Condo to a $1 Million House, The Difference a Year Makes in Interest Rates

From a $350,000 Condo to a $1 Million House, The Difference a Year Makes in Interest Rates

✉️ Want to forward this article? Click here.

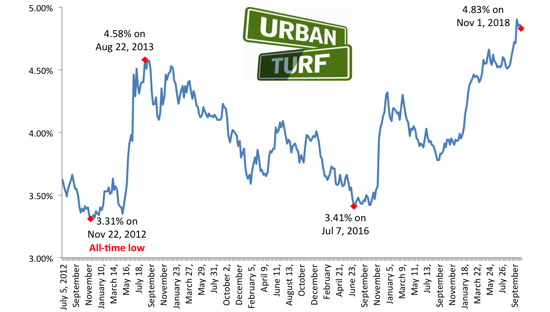

One year ago, the average rate for a 30-year fixed-rate mortgage was 3.94 percent. This week, Freddie Mac reported 4.83 percent as the average on this type of loan, an 89 basis point jump over 12 months. This change will effect how much new homebuyers pay on their monthly mortgage, so UrbanTurf took a closer look at how the rise in mortgage rates will impact buyers at three price points.

First, we took a look at how a homebuyer with excellent credit would fare purchasing a $350,000 home. Using the current rates and rates from last year, we examined how monthly mortgage payments have changed. For the price point, we looked at buyers who made a 20 percent down payment, and also buyers who made a 3.5 percent down payment.

story continues below

loading...story continues above

November 2017: The average mortgage rate was 3.94 percent.

Monthly mortgage payment (20 percent down): $1,327

Total outlay on mortgage (monthly payment x 360 months): $477,756

Monthly mortgage payment (3.5 percent down): $1,601

Total outlay on mortgage (monthly payment x 360 months): $576,292

November 2018: The average mortgage rate is 4.83 percent.

Monthly mortgage payment (20 percent down): $1,474

Total outlay on mortgage (monthly payment x 360 months): $530,690

Monthly mortgage payment (3.5 percent down): $1,778

Total outlay on mortgage (monthly payment x 360 months): $640,148

For buyers making a 20 percent down payment on a $350,000 unit, the difference between a rate of 3.94 percent and 4.83 percent is $147 per month, or $52,934 over the life of the loan.

On the other hand, for buyers making a 3.5 percent down payment, the difference between a rate of 3.94 percent and 4.83 percent is $177 per month, or $63,856 over the life of the loan.

Next, we took a look at how homebuyers with excellent credit would fare purchasing a $700,000 home, comparing payments based on last year's rates and this week's rates.

November 2017: The average mortgage rate was 3.94 percent.

Monthly mortgage payment (20 percent down): $2,654

Total outlay on mortgage (monthly payment x 360 months): $955,508

Monthly mortgage payment (3.5 percent down): $3,202

Total outlay on mortgage (monthly payment x 360 months): $1,152,583

November 2018: The average mortgage rate is 4.83 percent.

Monthly mortgage payment (20 percent down): $2,948

Total outlay on mortgage (monthly payment x 360 months): $1,061,384

Monthly mortgage payment (3.5 percent down): $3,556

Total outlay on mortgage (monthly payment x 360 months): $1,280,293

For buyers making a 20 percent down payment, the difference between a rate of 3.94 percent and 4.83 percent is $294 per month, or $105,876 over the life of the loan.

On the other hand, for buyers making a 3.5 percent down payment, the difference between a rate of 3.94 percent and 4.83 percent is $354 per month, or $127,710 over the life of the loan.

Last, we took a look at how homebuyers with excellent credit would fare purchasing a $1 million home.

November 2017: The average mortgage rate was 3.94 percent.

Monthly mortgage payment (20 percent down): $3,792

Total outlay on mortgage (monthly payment x 360 months): $1,365,012

Monthly mortgage payment (3.5 percent down): $4,574

Total outlay on mortgage (monthly payment x 360 months): $1,646,546

November 2018: The average mortgage rate is 4.83 percent.

Monthly mortgage payment (20 percent down): $4,212

Total outlay on mortgage (monthly payment x 360 months): $1,516,262

Monthly mortgage payment (3.5 percent down): $5,081

Total outlay on mortgage (monthly payment x 360 months): $1,828,991

For buyers making a 20 percent down payment, the difference between a rate of 3.94 percent and 4.83 percent is $420 per month, or $151,250 over the life of the loan.

On the other hand, for buyers making a 3.5 percent down payment, the difference between a rate of 3.94 percent and 4.83 percent is $507 per month, or $182,445 over the life of the loan.

See other articles related to: down payment, interest rates, mortgage rates, mortgages

This article originally published at https://dc.urbanturf.com/articles/blog/the-difference-a-year-makes-in-interest-rates-at-three-price-points/14650.

Most Popular... This Week • Last 30 Days • Ever

As mortgage rates have more than doubled from their historic lows over the last coupl... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

The longtime political strategist and pollster who has advised everyone from Presiden... read »

A report out today finds early signs that the spring could be a busy market.... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro