The Amazon Effect, or Lack Thereof, One Year Later

The Amazon Effect, or Lack Thereof, One Year Later

✉️ Want to forward this article? Click here.

In the year since Amazon announced it was establishing its second headquarters in Northern Virginia, UrbanTurf has periodically taken stock of various signs from the regional housing market indicating "HQ2"-fueled interest.

Now, a new report delves deeply into how the market has responded over the past year in anticipation of the Amazon campus.

CoreLogic's overall findings indicate a negligible impact on housing prices in the Washington-Arlington-Alexandria and Silver Spring-Frederick-Rockville metro areas, and it seems more reasonable to conclude that HQ2 shielded the area from the price dampening seen nationwide.

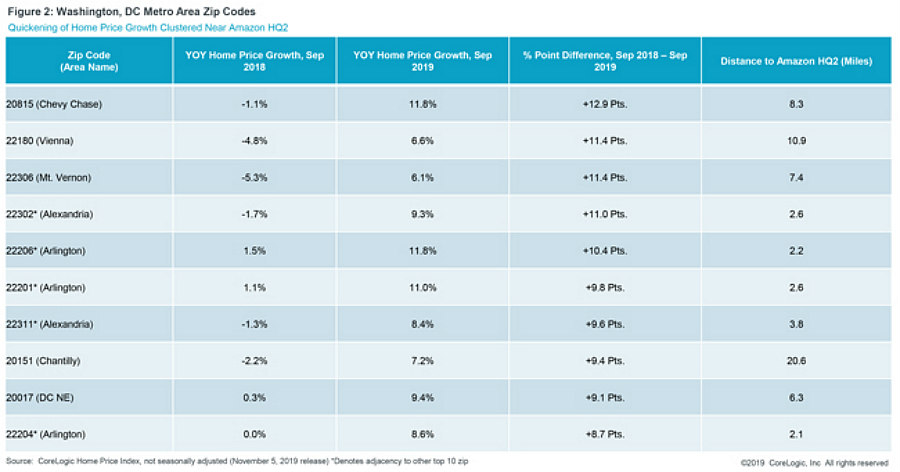

However, zip codes which boast close proximity to the future Amazon campus did see strong price growth. Five of the top 10 zip codes with the largest year-over-year growth in the region sit within four miles of HQ2, and eight are within ten miles.

story continues below

loading...story continues above

Prices in these zip codes rose anywhere from 8.7 to 12.9 percent. Interestingly, however, the three local zip codes with the strongest price growth are at least seven miles away from HQ2: 20815 (Chevy Chase), 22180 (Vienna), and 22306 (Mount Vernon).

The correlation between proximity to HQ2 and increased home prices was weak until March 2019. Overall, it may be too soon to definitively conclude that Amazon's plans have had a direct effect on the local housing market thus far, although there is evidence of a correlation between proximity and prices.

See other articles related to: amazon, amazon hq2, amazon hq2 real estate effect, amazon second headquarters, corelogic, national landing, northern virginia home prices

This article originally published at https://dc.urbanturf.com/articles/blog/the-amazon-effect-or-lack-thereof-one-year-later/16143.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

A new proposal is on the boards for the former home of the Transportation Security Ad... read »

The developer is under contract to purchase Land Bay C-West, one of the last unbuilt ... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- 637 Apartments, 31,000 Square Feet Of Retail: The New Plans for Pentagon City TSA Site

- The Last Piece of Potomac Yard: Mill Creek Residential Pitches 398-Unit Apartment Building

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro