What's Hot: Did January Mark The Bottom For The DC-Area Housing Market? | The Roller Coaster Development Scene In Tenleytown and AU Park

Still High, Long-Term Rates Head Back Down

Still High, Long-Term Rates Head Back Down

✉️ Want to forward this article? Click here.

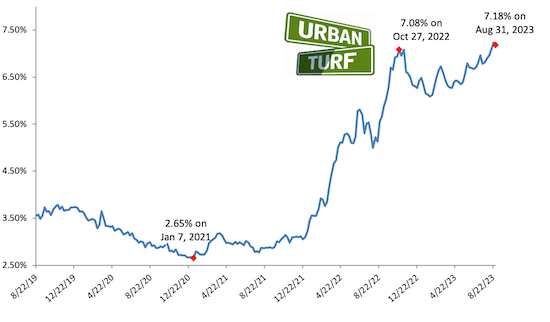

Long-term mortgage rates retreated from their 20-year highs this week.

Freddie Mac reported 7.18% as the average on a 30-year mortgage on Thursday, down 5 basis points from last week.

story continues below

loading...story continues above

“Mortgage rates leveled off this week but remain elevated. Despite continued high rates, low inventory is keeping house prices steady,” said Sam Khater, Freddie Mac’s Chief Economist. “Recent volatility makes it difficult to forecast where rates will go next, but we should have a better gauge in September as the Federal Reserve determines their next steps regarding interest rate hikes.”

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

See other articles related to: mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/still_high_long-term_rates_head_back_down/21418.

Most Popular... This Week • Last 30 Days • Ever

As mortgage rates have more than doubled from their historic lows over the last coupl... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

The longtime political strategist and pollster who has advised everyone from Presiden... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

A report out today finds early signs that the spring could be a busy market.... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro