Rent Vs. Buy: The 25-Year-Old Lawyer With a Boyfriend

Rent Vs. Buy: The 25-Year-Old Lawyer With a Boyfriend

✉️ Want to forward this article? Click here.

In our third test drive of the Rent vs. Buy calculator from The New York Times, UrbanTurf is crunching the numbers for one of our readers.

Before we get to the details, a quick refresher as to how the calculator works. Users input their monthly rent and their desired home price point, in addition to a slew of variables like down payment amount, probable mortgage rate, property taxes, condo fees and the rate of home value appreciation and rent increases in their area. The calculator then creates a graphical representation of the time it takes for one to break even on their investment, and the return on that investment going forward. The calculator also lets you compare figures across a theoretical number of years lived in the property, so you can see the cumulative savings or loss.

The tool is not perfect, though, primarily because it does not allow you to enter a variable home price appreciation or rent increase percentage. In other words, if a user enters a home price appreciation rate of 5 percent a year, that level of appreciation is assumed for the entire period of the loan. Similarly, other variables, like increasing condo fees, are not taken into consideration in the analysis.

Our first case was a young woman who was putting 10 percent down and using conventional financing. Next, we looked at a 32-year-old journalist with a smaller budget who was using FHA financing.

Check out our third potential buyer, an UrbanTurf reader, and the three different scenarios, based on varying home price appreciation and rental rate changes, below. If you want to give the calculator your own test, click here, and if you want us to include you as our next subject, email us at editor2013@urbanturf.com.

Colin — 25-year-old lawyer living with his boyfriend

Colin, a lawyer, and his boyfriend, a recruiter for the government, are currently paying $2,800 per month to rent a unit in Woodley Park. They are considering buying a two-bedroom in Columbia Heights, Shaw, the H Street Corridor, Eastern Market or Capitol Riverfront, and have a budget of $550,000. They can put down 10 percent of the total price, or $55,000.

Here are some of the other variables that we incorporated into the scenarios below:

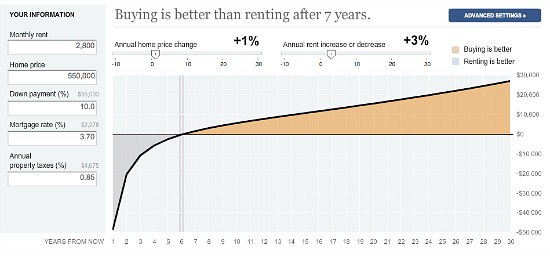

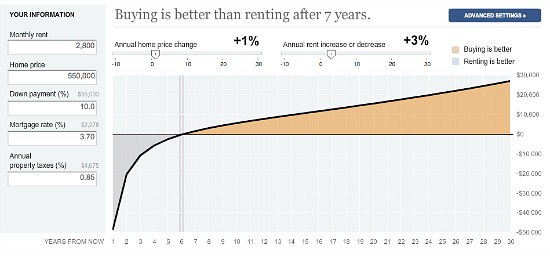

Scenario #1

Our first scenario assumes a home price appreciation of 1 percent a year, and a rental rate increase of 3 percent a year. Assuming these numbers, it would take Colin about 7 years to break even on his investment, according to the calculator. A graphical representation of the rent versus buy breakdown for this scenario can be seen below.

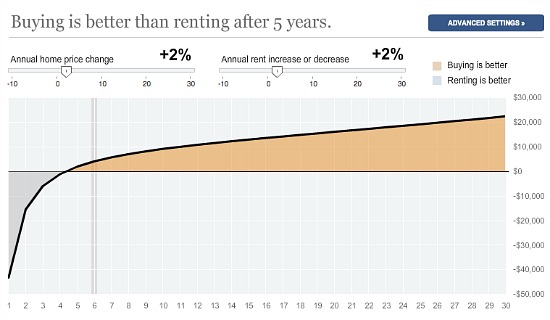

Scenario #2

Our second scenario assumes a home price appreciation rate of 2 percent a year, and a rental rate increase of 2 percent a year. Assuming these numbers, it would take Colin 5 years to break even on his investment, according to the calculator. A graphical representation of the rent versus buy breakdown for this scenario can be seen below.

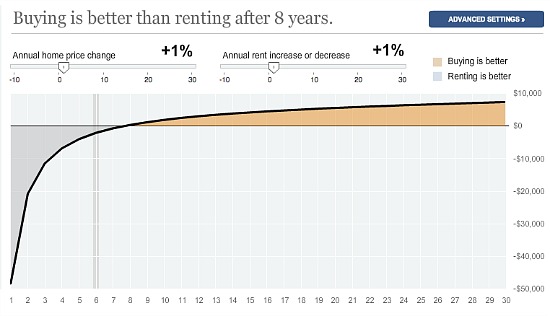

Scenario #3

Our third scenario assumes a home price appreciation rate of 1 percent a year, and a rental rate increase also of 1 percent a year. Assuming these numbers, it would take Patrick 8 years to break even on his investment, according to the calculator. A graphical representation of the rent versus buy breakdown for this scenario can be seen below.

See other articles related to: rent vs. buy

This article originally published at https://dc.urbanturf.com/articles/blog/rent_vs._buy_the_28-year-old_lawyer_with_a_boyfriend/6920.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro