The Rent Versus Buy Calculator Put to the Test, Part II

The Rent Versus Buy Calculator Put to the Test, Part II

✉️ Want to forward this article? Click here.

A few years ago, graphic editors Kevin Quealy and Archie Tse created a Rent vs. Buy calculator for The New York Times that has become perhaps the most-used internet tool when people are attempting to make a calculated decision to purchase a home.

“It is an interactive calculator that uses formulas to calculate the year-by-year costs of buying and renting,” Kevin Quealy told UrbanTurf in a 2010 article. “It then determines which is cheaper after each year.”

Given that it has been a little over two years since UrbanTurf put the calculator to the test, we decided that enough has changed in terms of the housing market in the DC area that it made sense to revisit its results.

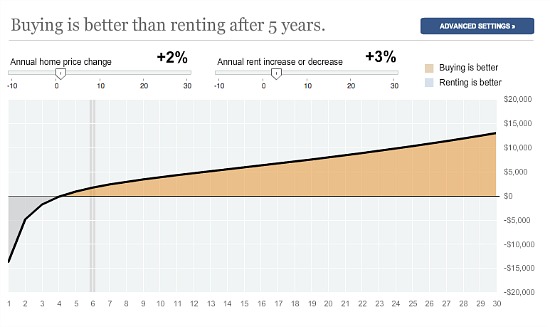

Here is how the calculator works. Users input their monthly rent and their desired home price point, in addition to a slew of variables like down payment amount, probable mortgage rate, property taxes, condo fees and the rate of home value appreciation and rent increases in their area. The calculator then creates a graphical representation of the time it takes for one to break even on their investment, and the return on that investment going forward. The calculator also lets you compare figures across a theoretical number of years lived in the property, so you can see the cumulative savings or loss.

The issue that we discovered with the calculator is that it does not allow you to enter a variable home price appreciation or rent increase percentage. In other words, if a user enters a home price appreciation rate of 5 percent a year, that level of appreciation is assumed for the entire period of the loan.

Still, we went ahead and tested it out for a potential buyer and provided three different scenarios, based on varying home price appreciation and rental rate changes that take into account the fact that home values and rental rates will rise and fall over the years.

Here is our potential buyer:

Ariel — 32-year-old consultant living in Logan Circle

Ariel is paying $2,600 a month for a 1,100 square-foot two-bedroom apartment with no roommate. She’d like to buy a comparable space in the area, where similar two-bedrooms are fetching $625,000. She knows that she has enough savings for a 10% down payment, and is pre-approved for a 30-year, fixed-rate mortgage at 3.9 percent.

Here are some of the other variables that we incorporated into the scenarios below:

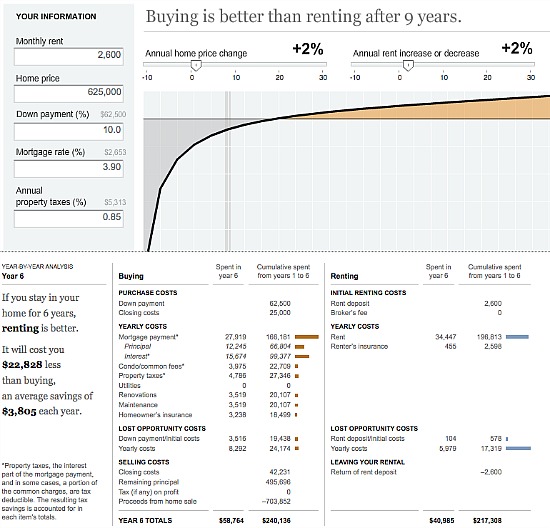

Scenario #1

Our first scenario assumes a rather modest home price appreciation of 2 percent a year, and a rental rate increase also of 2 percent a year. Assuming these numbers, it would take Ariel about nine years to break even on her investment, according to the calculator. A graphical representation of the rent versus buy breakdown for this scenario can be seen below.

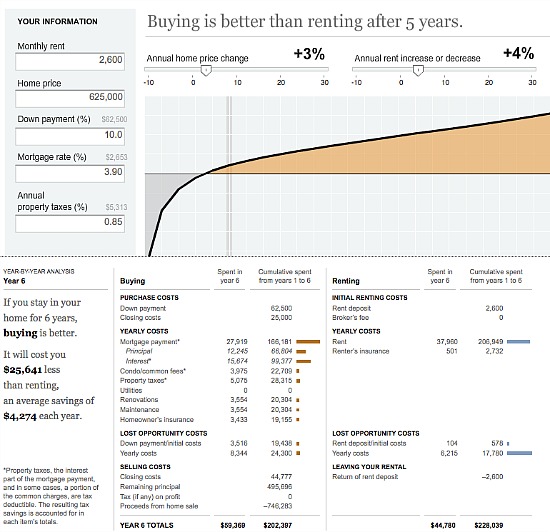

Scenario #2

Our second scenario assumes a home price appreciation rate of 3 percent a year, and a rental rate increase of 4 percent a year. Assuming these numbers, it would take Ariel about five years to break even on her investment, according to the calculator. A graphical representation of the rent versus buy breakdown for this scenario can be seen below.

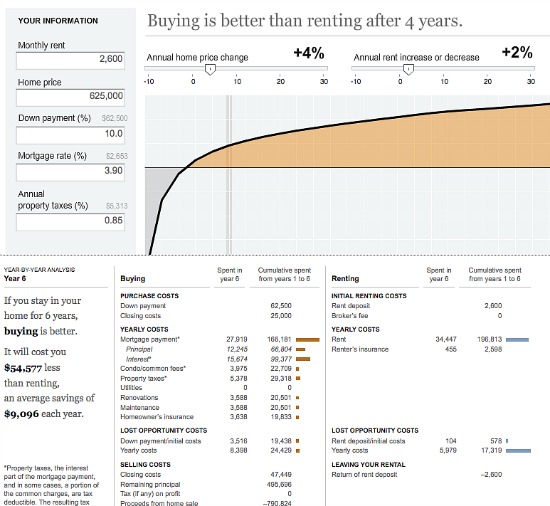

Scenario #3

Our third scenario assumes a home price appreciation rate of 4 percent a year, but a rental rate increase of just 2 percent a year. Assuming these numbers, it would take Ariel about four years to break even on her investment, according to the calculator. A graphical representation of the rent versus buy breakdown for this scenario can be seen below.

See other articles related to: home buying, rent, rent vs buy

This article originally published at https://dc.urbanturf.com/articles/blog/the_rent_versus_buy_calculator_put_to_the_test_part_ii/6709.

Most Popular... This Week • Last 30 Days • Ever

UrbanTurf takes a look at the options DC homeowners and residents have to take advant... read »

A major new residential development is on the boards for a series of properties near ... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The building is the second proposal for a pair of aging office buildings in downtown ... read »

The central action before the Board is a rezoning request for the nearly 36-acre site... read »

- A Solar Panel Primer for DC Residents

- 29-Story, 420-Unit Development Pitched For Middle Of Downtown Bethesda

- How DC's Population Changed During And After The Pandemic

- Fitting In: A Narrow 260-Unit Apartment Building Pitched For Bethesda

- Arlington County To Weigh Major Actions Advancing RiverHouse Redevelopment

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro