Rent Vs. Buy: The 32 Year-Old Journalist

Rent Vs. Buy: The 32 Year-Old Journalist

✉️ Want to forward this article? Click here.

A couple weeks ago, UrbanTurf took a test drive of the Rent vs. Buy calculator from The New York Times, perhaps the most-used internet tool when people are attempting to make a calculated decision to purchase a home.

That exercise was so well-received by our audience that we decided to make it a regular part of our editorial stream.

A quick refresher as to how the calculator works. Users input their monthly rent and their desired home price point, in addition to a slew of variables like down payment amount, probable mortgage rate, property taxes, condo fees and the rate of home value appreciation and rent increases in their area. The calculator then creates a graphical representation of the time it takes for one to break even on their investment, and the return on that investment going forward. The calculator also lets you compare figures across a theoretical number of years lived in the property, so you can see the cumulative savings or loss.

The tool is not perfect, though, primarily because it does not allow you to enter a variable home price appreciation or rent increase percentage. In other words, if a user enters a home price appreciation rate of 5 percent a year, that level of appreciation is assumed for the entire period of the loan.

Our first test case was a young woman who was putting 10 percent down and using conventional financing. This time around, we tested a man looking in a lower price point who used FHA financing. The differing break even points for each case are notable. In short, the break even point is much farther out if a buyer goes the FHA route.

Check out our new potential buyer (based on a friend of UrbanTurf) and the three different scenarios, based on varying home price appreciation and rental rate changes, below. If you want to give the calculator your own test, click here, and if you want us to include you as our next subject, email us at editor2013@urbanturf.com.

Patrick — 32-year-old journalist living in Shaw

Patrick pays $1,500 per month to rent a 700-square-foot one-bedroom apartment in Shaw. He’s looking for a comparable space in the same area, where similar units cost about $350,000. His savings are not too deep, but he feels that he could come up with a down payment of 3.5 percent, or $12,250 in this case, for an FHA-backed mortgage with an interest rate of 3.9 percent.

Here are some of the other variables that we incorporated into the scenarios below:

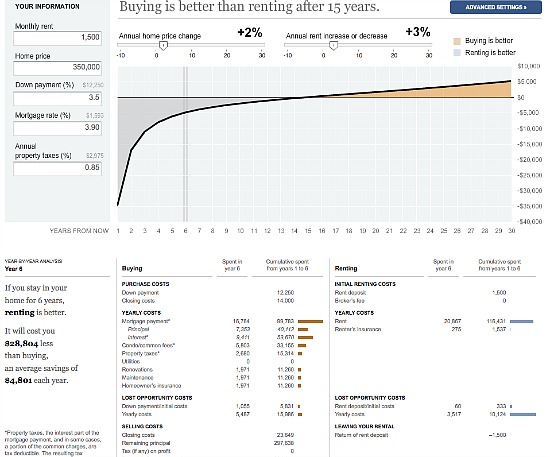

Scenario #1

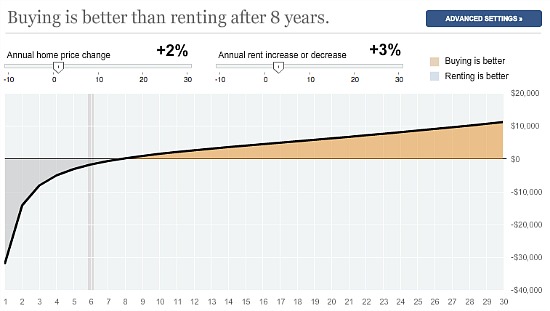

Our first scenario assumes a home price appreciation of 2 percent a year, and a rental rate increase of 3 percent a year. Assuming these numbers, it would take Patrick about 15 years to break even on his investment, according to the calculator. A graphical representation of the rent versus buy breakdown for this scenario can be seen below.

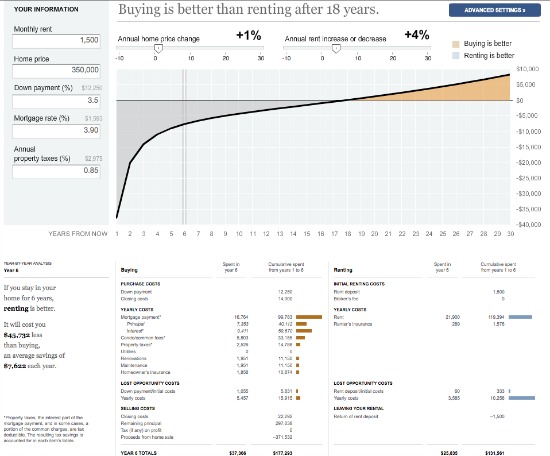

Scenario #2

Our second scenario assumes a home price appreciation rate of 1 percent a year, and a rental rate increase of 4 percent a year. Assuming these numbers, it would take Patrick 18 years to break even on his investment, according to the calculator. A graphical representation of the rent versus buy breakdown for this scenario can be seen below.

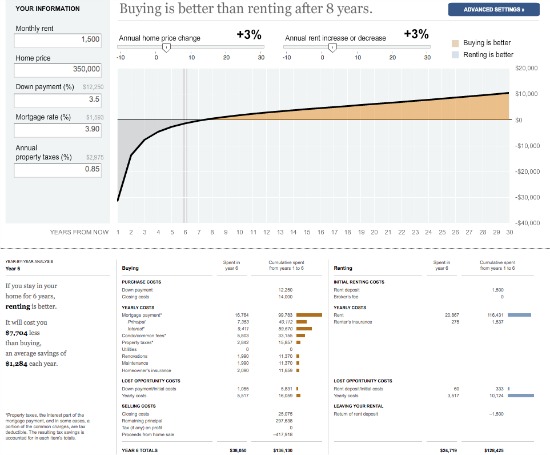

Scenario #3

Our third scenario assumes a home price appreciation rate of 3 percent a year, and a rental rate increase also of 3 percent a year. Assuming these numbers, it would take Patrick about eight years to break even on his investment, according to the calculator. A graphical representation of the rent versus buy breakdown for this scenario can be seen below.

See other articles related to: rent vs buy, renting in dc

This article originally published at https://dc.urbanturf.com/articles/blog/rent_vs_buy_32_year_old_journalist/6785.

Most Popular... This Week • Last 30 Days • Ever

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

While condo fees are often predictable, there are instances when they may need to be ... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

One of the most ambitious federal housing proposals in years is moving through the le... read »

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- How Do Condo Buildings Determine When Condo Fees Need to Be Increased

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

- What Is In The Big New Housing Bill?

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro