Will Interest Rates Be Above 4 Percent By Mid-June?

Will Interest Rates Be Above 4 Percent By Mid-June?

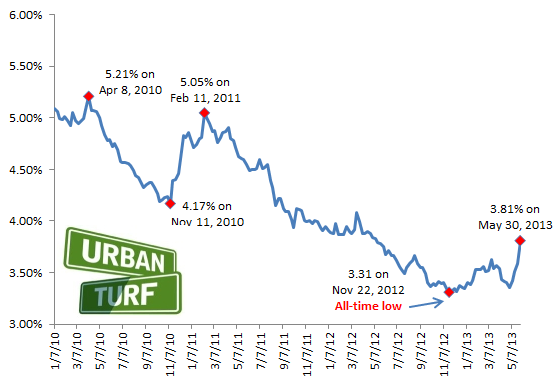

The path of rates since January 2010.

For the past 18 months, the average long-term interest rate reported by Freddie Mac each week has been below 4 percent. In fact, sub-4 percent rates have become so common that the idea that two years ago people marveled at rates dipping below 4 percent seems almost humorous.

However, recent indicators point to rates going back above 4 percent in the very near future, and not returning to historic lows for quite some time.

Yesterday, it was reported that the average on a 30-year fixed-rate mortgage had leapt to 3.81 percent from 3.59 percent the previous week and 3.42 percent two weeks prior. Since the beginning of the month, rates have risen almost 50 basis points.

There are a number of reasons that rates are now increasing, most notably unemployment numbers are going down, economic indicators are going up, housing starts are increasing, durable goods orders are on the rise, and both global and U.S. stocks have advanced substantially.

Also, Federal Reserve Chairman Ben Bernanke’s comments from a week ago indicated the government will be tapering off their Quantitative Easing strategy. Right now, the government is actively participating in purchasing long-term mortgage-backed securities to keep interest rates artificially low.

“The trend has been that interest rates have drifted lower very slowly,” BB&T’s Kevin Connelly told UrbanTurf. “But when the tide turns due to economic indicators or news like Bernanke’s testimony, that causes a knee jerk reaction and suddenly interest rates jump.”

So does all this point to the possibility that rates could be above 4 percent by next Thursday’s Freddie Mac report? For many borrowers, even those with excellent credit, rates have already crossed that benchmark.

“Right now, it appears most lenders are priced at 3.875 percent for loans under $417,000, with loans over that amount already at 4 percent,” John Downs of Caliber Funding said. “This is partly due to the market sell-off but also because of pricing confusion. When banks are confused, they often err on the side of caution and show elevated rates until the market stabilizes. In my opinion, rates will most likely plateau until the May jobs report, which will be published on June 7th.”

Readers, what do you think? Are rates set to jump back above 4 percent in the next few weeks?

See other articles related to: mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/mortgage_rates_leap_up._here_is_why_they_may_remain_high/7130.

Most Popular... This Week • Last 30 Days • Ever

Plans for another residential project in downtown Bethesda are moving forward.... read »

Cash-out refinancing is a popular financial strategy that allows homeowners to conver... read »

This weekend, the Gallery-Place Chinatown Task Force pitched its ideas to Mayor Murie... read »

Nearly one million square foot development planned in Wheaton; the renovation regrets... read »

Originally listed in February for $8.5 million, the price for the late California sen... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro