Mortgage Demand Rises After Fed Signals Pause in Rate Hikes

Mortgage Demand Rises After Fed Signals Pause in Rate Hikes

✉️ Want to forward this article? Click here.

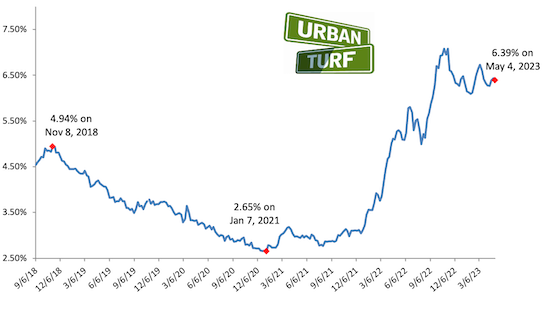

Mortgage refinancing and purchase demand rose last week after the Federal Reserve signaled that it would pause rate hikes.

Mortgage application volume rose 7% week-over-week, the Mortgage Bankers Association (MBA) reported on Wednesday.

story continues below

loading...story continues above

“Mortgage applications responded positively to a drop in rates last week, as the Fed signaled a potential pause at the current level for the federal funds rate in anticipation of inflation slowing and tightening financial conditions that will slow economic and job growth," Joel Kan, MBA’s Vice President and Deputy Chief Economist, said in a release. "Lower rates from week to week have helped buyers in the market, but limited for-sale inventory remains a challenge for many homebuyers."

On Thursday, Freddie Mac will release its weekly interest rates, so it will be interesting to see if rates fall as the result of the Federal Reserve's signals.

This article originally published at https://dc.urbanturf.com/articles/blog/mortgage_demand_rises_after_fed_signals_pause_in_rate_hikes/21004.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro