Low Apartment Vacancy and High Rents Continue for DC Area in 2011, Report Says

Low Apartment Vacancy and High Rents Continue for DC Area in 2011, Report Says

✉️ Want to forward this article? Click here.

Rendering of apartments at 2400 14th Street NW

A word of advice for DC-area renters: Hold on to your apartment, hold onto it as long as you can.

As we have reported, trying to find a reasonably-priced rental in the DC area is no easy feat and according to Delta Associates year-end report on the region’s apartment market, it is only going to get tougher in the coming year. Here are some of the report’s highlights:

- An oncoming shortage of apartment units in 2011 and 2012 means that vacancy rates in the region will continue to drop.

- Rental rates have yet to peak and are steadily marching higher for Class A and B apartments.

- Prevalent a year ago, rental concessions are now rare as demand grows.

- Job growth in the region will ensure a stream of new residents looking for housing.

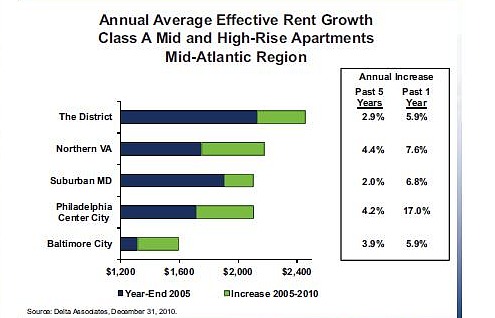

With national vacancy rates lingering at 6.6 percent, DC area vacancy levels for Class A and B apartments are at 3.4 percent, down from 4.3 percent a year ago, according to the report. In DC proper, vacancy rates are actually up slightly (3.8%) from last year (3.7%), but submarkets like Columbia Heights/Shaw have the lowest stabilized vacancy rate in the region at 2.8 percent. To compound the low vacancy rate, average rents for Class A mid and high-rise apartments in the District have increased almost 6 percent in 2010, and a tremendous 14 percent in the Upper Northwest submarket (which includes areas like Dupont Circle and Georgetown).

Rental rate growth in DC Area. Courtesy of Delta Associates.

“Monthly rents in DC have gone up $324 a month on average in the last five years,” Grant Montgomery, a vice president at Delta Associates told UrbanTurf. “We think the region will see Class A rents increase 10 to 11 percent on average over the next 12 to 18 months.”

As rents increase and vacancy remains low, the days when 2-3 months of free rent or various electronics were dangled in front of renters to get them to sign a lease seem to be a thing of the past. Such concessions were widespread in newly leasing apartments at the end of 2009 and in early 2010, but the practice has become less prevalent towards the end of the year, the report said, noting that on average renters received only 3.5 percent concessions on annual rent in 2010 compared with 7.2 percent in 2009. (For context, a month’s free rent is equal to an 8.3 percent concession on annual rent in the DC area.)

“When renters get ready to renew next year they are more likely to see a much bigger jump [in their rental rate],” Montgomery said. “And those people that hop to a new project will see concessions declining from where they were a year ago.”

Further complicating things is the inventory of new apartments in the region. Montgomery explained that since the number of new projects peaked in 2009 construction has been steadily tracking downward until this year when construction ramped back up and developers broke ground on more than 5,000 units in the region. However, analysts at Delta Associates said that the new apartments will not hit the market soon enough. Stabilized vacancy rates for Class A apartments will continue to decrease in the next few years, potentially bottoming out at two percent by the end of 2012.

“The lag in supply in many submarkets is changing who is in the driver’s seat between renters and owners,” Montgomery said. “As vacancies decline and less product is on the market, owners can push rents more.”

See other articles related to: dc apartments, delta associates, maryland apartments, northern virginia apartments, renting in dc

This article originally published at https://dc.urbanturf.com/articles/blog/low_vacancy_rent_increases_and_few_concessions/2805.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro