How Can Parents Transfer Real Estate to Their Children?

How Can Parents Transfer Real Estate to Their Children?

✉️ Want to forward this article? Click here.

For many parents, transferring real estate to their children is an important part of their estate planning process. There are several ways that parents can do this, each with its own advantages and disadvantages.

In this article, UrbanTurf will explore some of the more common ways that parents transfer real estate to children.

story continues below

loading...story continues above

- Gifting -- One of the simplest ways for parents to transfer real estate to their children is through a gift. In this method, parents simply transfer ownership of the property without any exchange of money. While gifting does not involve any tax implications for the children, it may trigger a gift tax for the parents if the value of the property exceeds the annual gift tax exclusion limit, which in 2024 is $18,000.

- Sale -- In this method, the parents sell the property to their children at a reduced price or with a low interest rate mortgage. This can be beneficial for both parties, as the parents can receive some financial compensation, and the children can acquire the property at a lower cost.

- Trusts -- Parents can also transfer real estate to their children through a trust. In this scenario, the parents set up a trust that holds the property, and the children are named as beneficiaries. The trust can be structured in a way that allows the children to receive income from the property, or they can receive the property outright at a specified time. Trusts can also provide tax benefits for both the parents and the children.

- Joint ownership -- Parents can also transfer real estate to their children through joint ownership, which mean the parents add their children's names to the property title, making them co-owners of the property. Joint ownership can provide several benefits, such as avoiding probate and allowing for the seamless transfer of ownership in the event of the parents' death.

- Life estate -- In this method, parents transfer ownership of the property to their children while reserving the right to live in the property until their death. This method allows parents to retain ownership and control of the property during their lifetime while ensuring that the property will eventually pass to their children.

Transferring real estate to children can be a complex process, so it is important to consult with an estate planning attorney when considering one of the options above.

Have a real estate-related question that you want UrbanTurf to cover? Shoot us an email at editor(at)urbanturf.com.

See other articles related to: transferring real estate

This article originally published at https://dc.urbanturf.com/articles/blog/how_can_parents_transfer_real_estate_to_their_children/20750.

Most Popular... This Week • Last 30 Days • Ever

Buffett called the five-bedroom listing home when his father, Howard Buffett, was ser... read »

Monument Realty has filed updated plans with Arlington County to redevelop the former... read »

What Republican control could mean for DC; the Post wants people back in the office; ... read »

A single home has come up for sale at Beale Square: an acclaimed, carriage-style town... read »

The sale of the 9,100 square-foot residence in Chevy Chase closed in October.... read »

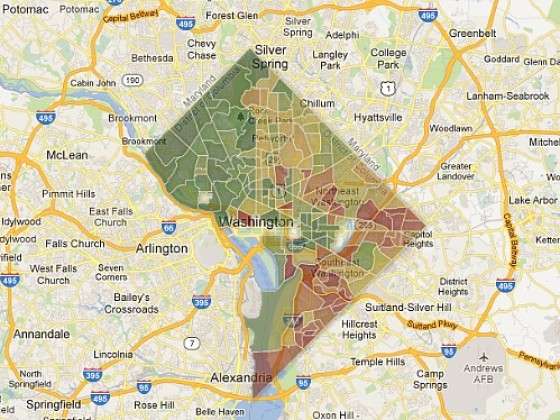

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro