What's Hot: What Is In The Big New Housing Bill?

How to Legally Rent on Airbnb in DC

How to Legally Rent on Airbnb in DC

✉️ Want to forward this article? Click here.

A Shaw carriage house available on Airbnb.

As our article from earlier today pointed out, it’s not hard to start hosting people on Airbnb, and for those living in central locations throughout DC, the money can be great. But what many users don’t (or won’t) consider is whether or not the temporary rental they offer is operating legally.

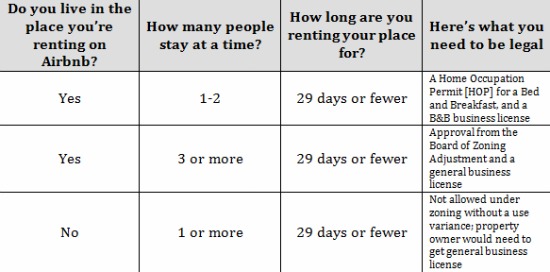

UrbanTurf reached out to the Department of Consumer and Regulatory Affairs for details regarding what an Airbnb host can do to avoid running afoul of District regulations. Here’s what they told us, in one handy chart:

It is important to note that the information provided in the chart only covers the business and basic permits a person would need to avoid DCRA fines. But there could be other city regulations to keep in mind, including ones related to the fire code. And that’s not all: If you own a condo or co-op, your board likely prohibits units in the building from being from rented for less than 30 days at a time (and sometimes the minimum time limit is higher).

Airbnb hosts may be surprised to learn that pretty much any short-term renting scenario requires some kind of permit. But Airbnb lists the following caveat in all caps in its terms of service: “Airbnb cannot and does not control the content contained in any listings and the condition, legality or suitability of any accommodations.” Later, it states that the service “assumes no responsibility for a Host’s compliance with any applicable laws, rules and regulations.”

Since hosts can’t count on Airbnb to bail them out if they get into trouble, it’s a good move to confirm a rental is operating legally.

See other articles related to: airbnb, airbnb dc, airbnb illegal, dclofts

This article originally published at https://dc.urbanturf.com/articles/blog/heres_how_to_legally_rent_on_airbnb_in_dc/8068.

Most Popular... This Week • Last 30 Days • Ever

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

A new proposal is on the boards for the former home of the Transportation Security Ad... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- 637 Apartments, 31,000 Square Feet Of Retail: The New Plans for Pentagon City TSA Site

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro