What's Hot: Douglas Development Files PUD For Large Warehouse At New City Site Along New York Avenue

The Slow Return of DC's Housing Inventory

The Slow Return of DC's Housing Inventory

✉️ Want to forward this article? Click here.

For the past week, UrbanTurf has been publishing the predictions and trends that local industry professionals believe will play out in the fall housing market.

However, if there is one ongoing trend that seems to be on the mind of most DC area homebuyers it is the region’s chronically low inventory of homes for sale.

Today, Jonathan Hill and Corey Hart of local data firm RealEstate Business Intelligence lay out the reasons why they think inventory will be coming back, albeit slowly, in the coming months.

The Slow Return of Inventory

By Jonathan Hill and Corey Hart of RealEstate Business Intelligence

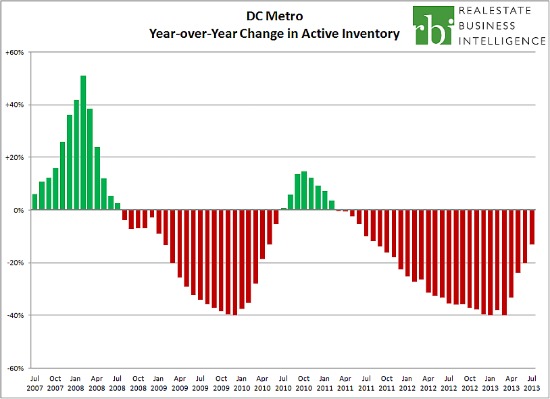

The DC area housing market bottomed out pricing-wise in 2009, two years before most U.S. markets started turning around. On a monthly basis, the annual appreciation in median sale price has averaged +5.4% since January 2010. One might assume that the consistent price improvements over the last 42 months would lead to an uptick in listing activity. This did not happen. In 2012, the average year-over-year change in new listings each month fell 7 percent, even though the average year-over-year change in closed sales increased 7 percent. The result? Inventory rapidly declines and the median sale price in 2012 was up 8 percent over 2011. Supply was getting trounced by demand.

Fortunately for frustrated buyers, this trend has shifted of late. Possibly due to increased awareness of favorable local market conditions, new listing activity in the DC area has finally begun to outpace the previous year. In fact, there were over 25 percent more newly listed homes in July 2013 than in July 2012 and new listing activity has now been increasing by double-digits for four consecutive months. While the total housing inventory in the area at the end of July was 13 percent below last year’s level (and contract activity continues to outpaced 2012 levels), the inventory nosedive has begun to flatten out.

What could this mean for the fall? After 25 consecutive months of double-digit annual declines, we predict inventory will finally begin to grow, albeit modestly. New contracts should continue to outpace last year’s levels, but the year-over-year growth in new listing activity should put the brakes on our incredibly shrinking inventory. While any potential increase in inventory is a positive indicator for buyers, they’ll need to stay on their toes. It’s unlikely we’ll approach the sub-2 months-of-supply level reached in the first half of the year. None of the housing metrics we see indicate the market will be balanced (~around 6 months of supply) anytime soon. Sellers will remain in the dominant position at most negotiating tables throughout the region and modest appreciation will continue as a result of the supply/demand imbalance.

See below for more fall predictions.

- More Choices, More Concessions For Renters

- The Private Sector Will Sustain DC’s Economy

- Cash is King and A Buyer’s Market?

This article originally published at https://dc.urbanturf.com/articles/blog/fall_market_predictions_the_slow_return_of_inventory/7521.

Most Popular... This Week • Last 30 Days • Ever

When you buy a home in the District, you will have to pay property taxes along with y... read »

The largest condominium building in downtown DC in recent memory is currently under c... read »

The plan to convert a Dupont Circle office building into a residential development ap... read »

The Rivière includes just 20 homes located on the eastern banks of the Anacostia Riv... read »

Why Tyra Banks is serving ice cream in DC; a bike shop/record store opens in Adams Mo... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro