What's Hot: A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

Fall Predictions: Mortgage Rates Will Remain Flat for Rest of 2014

Fall Predictions: Mortgage Rates Will Remain Flat for Rest of 2014

✉️ Want to forward this article? Click here.

As fall approaches, there are a number of questions floating around about the DC area housing market. Will inventory continue to come online making it a buyer’s market? Will the slew of new apartments entering the rental market push rents down? Will mortgage rates head higher as experts have predicted?

With these questions in mind, each day this week UrbanTurf will be hearing the predictions and trends that local industry professionals believe will play out in the fall market.

Mortgage Rates Will Remain Flat for the Rest of 2014

By Bill Slosberg, First Savings Mortgage

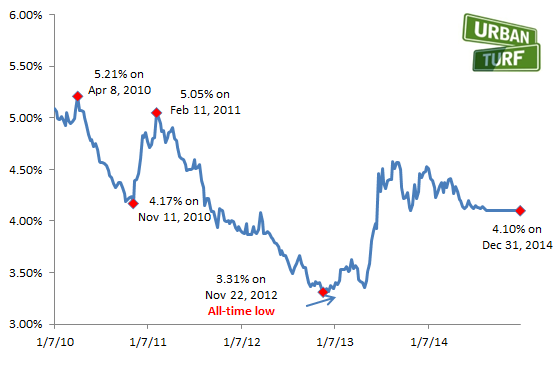

Last year ended with many experts forecasting an increase in mortgage rates during 2014. This was based on an expectation of rising employment and GDP numbers. However, this has not turned out to be the case. On January 2, Freddie Mac reported 4.53 percent with an average 0.8 point on a 30-year mortgage, a rate that they haven’t reached or eclipsed in 2014.

Beginning in mid-April, mortgage rates began a slow descent, spending most of the summer at around 4.125 percent with an average 0.5 point. The descent occurred despite six straight months of employment reports showing monthly gains of over 200,000 new jobs. Many experts were forecasting that the jobs number would continue to increase and the Federal Reserve would finally start raising short term rates in the spring of 2015. Then the world starting falling apart with the Mideast crisis, the Russian/Ukraine dispute and the sudden awareness by the public of the danger the United States faces from the growth of ISIS.

The September employment report showing the creation of a disappointing 142,000 new jobs was another wake up call. Interest rates declined rapidly after the news but soon a general dismissal of the accuracy of the report caused interest rates to retreat to their previous levels.

With all of this uncertainty, I predict that mortgage interest rates will remain at their current level for the remainder of the year. Despite the lack of confidence in the September employment report, big investors will wait for the October report with its expected revisions to this month’s report. Assuming that report shows the jobs number back around 200,000, big investors will want to see what comes out in November and December to confirm that August was an aberration.

Current weather forecasts are for another harsh winter which would slow the economy overall, as well as home sales and employment, I expect the 2014 fourth quarter GDP number and the 2015 first quarter GDP number to be below expectations. That should give the Fed pause, moving back any announcement of an increase in short term rates to at least the third quarter of next year. And if it is not clear that the economy is definitely back on track, I think the Fed will wait until 2016. Historically, since 1990, the Federal Reserve has been extremely reluctant to raise interest rates in the fourth quarter for fear of slowing the economy during the all-important holiday purchasing months.

It is important to note that the mortgage market tends to move several months before the Federal Reserve takes action, assuming it is pretty clear what the Fed is about to do. So I predict that homeowners and potential homeowners will experience a stable mortgage rate environment for at least the next twelve months. And when mortgage rates rise, the increase will be much smaller than usual.

This article originally published at https://dc.urbanturf.com/articles/blog/fall_market_predictions_mortgage_rates_will_remain_flat/8943.

Most Popular... This Week • Last 30 Days • Ever

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

Chris Hughes and husband Sean Eldridge are putting their Kalorama home on the market ... read »

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- Facebook Co-founder Lists DC Home For Sale

- One of DC's Oldest Homes Is Hitting the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro