DC Home Prices Hit Highest Level on Record

DC Home Prices Hit Highest Level on Record

✉️ Want to forward this article? Click here.

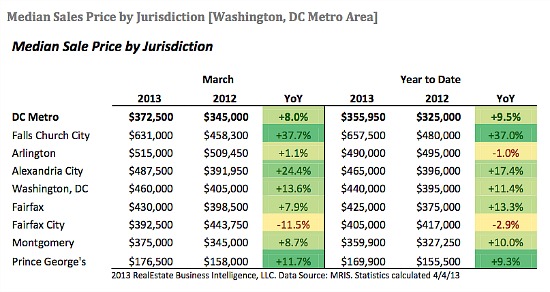

Home prices in the District of Columbia rose 13.6 percent between March 2012 and March 2013 to reach a median sales price of $460,000, the highest on record for the city, according to a report released by RealEstate Business Intelligence on Wednesday.

In northern Virginia, the price increases were even more notable; Alexandria and Falls Church saw prices rise 24 percent and 37 percent, respectively. March also marked the fifth month in a row that the median price in the DC area increased (year-over-year) by double digits.

Even as prices rise in the region, homes are selling at their fastest rate in eight years, according to the report.

The median number of days that a home for sale is spending on the market is a mere 15 days currently. To put that number in perspective, homes are now selling about three times faster than just 12 months ago.

Despite evidence that it is a very attractive time to be a seller, a low inventory of homes on the market continues to plague the region. The RBI report reveals that there were 6,289 active listings in the DC area at the end of March, 4,200 fewer listings compared to last March.

More on inventory from the report:

The subtle signs of improvement in new listings that occurred last month have faded. There were 5,817 new listings in March, 15.8 percent lower than last March. New listings rose 28.1 percent from last month, but this is well below the 10-year average February-to-March change for the region of +41.1 percent.

Here are a few other interesting statistics from the report:

- The average sales-to-original-list-price ratio reached 97.6 percent in March, the highest ratio in nearly 7 years.

- Closed home sales rose 6.7 percent, the 12th consecutive month with a year-over-year gain.

The area that RBI analyzes includes DC, Montgomery County, Prince George’s County, Alexandria City, Arlington County, Fairfax County, Fairfax City, and Falls Church City.

Similar Posts:

See other articles related to: dc home and condo prices, dc home prices, dclofts, mris, realestate business intelligence

This article originally published at https://dc.urbanturf.com/articles/blog/dc_home_prices_hit_highest_level_on_record/6913.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro