Case Shiller: DC Area Home Prices Rise 3.6%

Case Shiller: DC Area Home Prices Rise 3.6%

✉️ Want to forward this article? Click here.

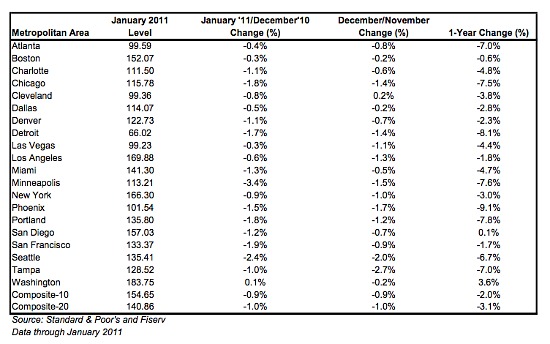

Continuing the trend of outpacing the rest of the country, the DC area posted a 3.6 percent year-over-year increase in home prices between January 2010 and January 2011, according to the latest Case-Shiller report released this morning. Nationally, home prices in the 20-city index decreased 3.1 percent during that period. Economists predicted that prices would fall 3.3 percent in January, after a 2.4 percent drop in December.

Case Shiller January 2011

The DC area market was one of only two metropolitan markets (the other being San Diego) that showed a year-over-year increase.

From the report:

Only San Diego and Washington D.C. posted positive annual growth rates in January 2011. These are the only two cities whose annual rates remained positive throughout 2010.

Prices increased ever so slightly (0.1 percent) in the DC area between December 2010 and January 2011. That increase is small, but it represented an increase in each home price tier measured by Case Shiller: lower (under $293,756), middle (between $293,756 and $457,827) and high (above $457,827).

Washington DC appears to be the only market that has weathered the recent storm. While it was up only 0.1% for the month of January, it’s annual rate was a relatively healthy +3.6%, it is still +10.7% above its March 2009 low, and ranks number one among the 20 markets as its average value is almost 85% above its January 2000 level.

Positive news for the DC area notwithstanding, this morning’s report offered a bleak assessment of the overall national market, noting that evidence of a double-dip housing recession is mounting:

The housing market recession is not yet over, and none of the statistics are indicating any form of sustained recovery. At most, we have seen all statistics bounce along their troughs; at worst, the feared double-dip recession may be materializing.

See other articles related to: case-shiller, dc area market trends, dc home prices, dclofts

This article originally published at https://dc.urbanturf.com/articles/blog/case_shiller_dc_home_prices_rise_3_6/3238.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro