What's Hot: Cash Remained King In DC Housing Market In 2025 | 220-Unit Affordable Development Planned Near Shaw Metro

$330 a Month: The Difference 3 Months Makes in Interest Rates

$330 a Month: The Difference 3 Months Makes in Interest Rates

✉️ Want to forward this article? Click here.

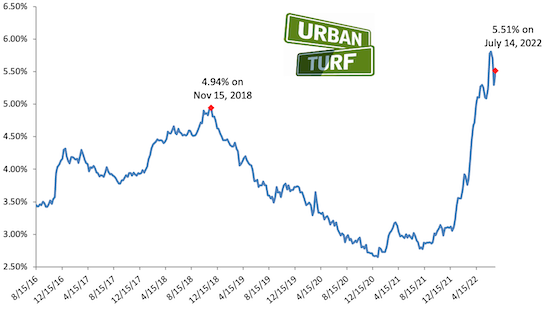

The rise in long-term interest rates in recent months has changed the budget outlook for many homebuyers.

So today, UrbanTurf is taking a look to see how current rates are impacting mortgage payments compared to just three months ago.

We took a home with an $800,000 purchase price and assumed the buyer has excellent credit. Using the current rates and rates from April, we examined how monthly mortgage payments changed. In each case, we assumed the buyer put down a 20 percent down payment. Note that these include principal and interest, but not the cost of insurance or taxes.

story continues below

loading...story continues above

Here are the two scenarios:

April 2022: The average mortgage rate was 4.67 percent.

Monthly mortgage payment: $3,307

Total outlay on mortgage (monthly payment x 360 months): $1,190,000

July 2022: The average mortgage rate is 5.51 percent.

Monthly mortgage payment: 3,637

Total outlay on mortgage (monthly payment x 360 months): $1,309,629

So, the difference between a rate of 4.67 percent and 5.51 percent is $330 a month or $119,000 over the life of the loan.

See other articles related to: interest rates, mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/330-a-month-the-difference-3-months-makes-in-interest-rates/19890.

Most Popular... This Week • Last 30 Days • Ever

Only a few large developments are still in the works along 14th Street, a corridor th... read »

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro