What's Hot: Raze Application Filed For Site Of 900-Unit Development, Food Hall Along Anacostia River

Why Interest Rates Should Be 3.4%

Why Interest Rates Should Be 3.4%

✉️ Want to forward this article? Click here.

This morning, The Wall Street Journal had an intriguing article as to why long-term mortgage rates should be even lower than their already-historic lows.

The piece points to the fact that the gap between what borrowers pay for mortgages and the rate that investors pay for bonds backed by home loans is getting wider. On Tuesday, it was 0.96 percent; historically it has hovered around .5 percent.

The Wall Street Journal unfortunately does not get into the financial nitty gritty of how the gap translates into lower rates, but it did offer this:

To be sure, consumers are seeing the lowest rates in several generations already. If history is any guide, it should be a lot lower. With yields on mortgage-backed securities at these levels, the 30-year fixed rate mortgages would be roughly 3.40% if the spread was around its historical average of 0.50 percentage points.

So, why aren’t rates even lower? A couple of reasons provided included that fewer banks are doing the majority of lending these days, so they don’t need to offer “rock bottom prices” and the increased regulations and risks associated with the mortgage market.

See other articles related to: mortgage lending, mortgage rates, mortgages, the wall street journal

This article originally published at https://dc.urbanturf.com/articles/blog/why_interest_rates_should_be_3.4/5174.

Most Popular... This Week • Last 30 Days • Ever

Estate taxes, also known as inheritance taxes or death duties, are taxes imposed on t... read »

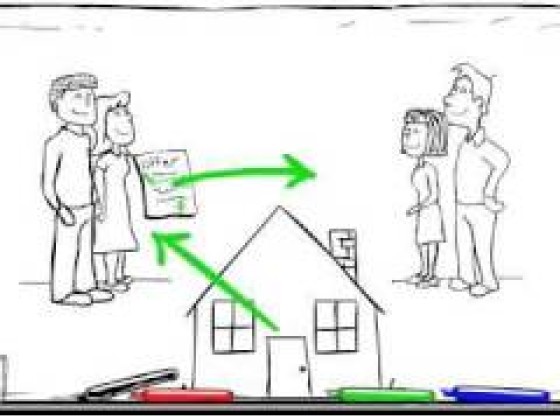

In this article, UrbanTurf will explore the considerations and steps involved in buyi... read »

The most expensive home to sell in the DC region in years closed on Halloween for an ... read »

Paradigm Development Company has plans in the works to build a 12-story, 110-unit con... read »

The application may signal movement on the massive mixed-use project.... read »

- What Are Estate Taxes and How Do They Work?

- How An Unmarried Couple Buys a Home Together

- The Cliffs in McLean Sells For $25.5 Million, Highest Home Sale In DC Area In Years

- 110-Unit Condo Project Planned in Alexandria Coming Into Focus

- Raze Application Filed For Site Of 900-Unit Development, Food Hall Along Anacostia River

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro