What's Hot: Just Above 6%: Mortgage Rates Drop To 2022 Lows | Facebook Co-founder Lists DC Home For Sale

Why Are Mortgage Rates So High?

Why Are Mortgage Rates So High?

✉️ Want to forward this article? Click here.

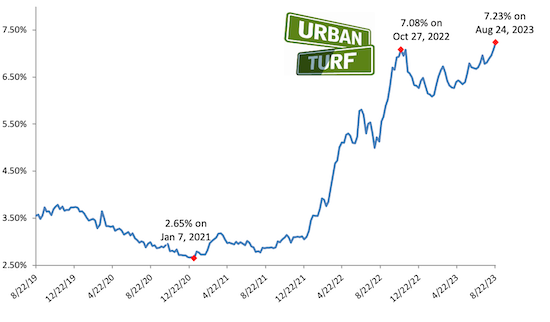

Week in and week out, UrbanTurf reports on the average mortgage rate reported by Freddie Mac. In the last year, that average has more than doubled to its highest level in more than two decades. This article delves into the reasons behind the surge in mortgage rates, shedding light on the various factors that have contributed to this upward trajectory.

story continues below

loading...story continues above

Economic Recovery and Inflation

One of the primary things driving the increase in mortgage rates is the broader economic landscape, specifically the rise in inflation. As economies around the world rebounded from the impact of the COVID-19 pandemic, central banks implemented policies to support economic growth. These policies included low-interest rates and quantitative easing which can inadvertently contribute to inflationary pressures. Inflation erodes the purchasing power of a currency, prompting central banks to raise interest rates to maintain stability. As central banks departed from ultra-low interest rates, mortgage rates, which are influenced by broader economic trends, rose in tandem.

Federal Reserve Policy Shift

The actions of the U.S. Federal Reserve play a pivotal role in shaping the mortgage rate landscape. For years, the Federal Reserve maintained historically low interest rates to stimulate economic activity. However, as the economy recovered, the Federal Reserve tapered its bond-buying program and raised interest rates.

Bond Market Dynamics

Mortgage rates are also closely tied to the yields of long-term government bonds, particularly the 10-year U.S. Treasury note. These bonds serve as a benchmark for determining the interest rates charged on various forms of credit, including mortgages. When bond yields rise, lenders may increase mortgage rates to align with market conditions. The yield on the 10-year note recently hit its highest point in 17 years, reflecting the Federal Reserve’s efforts to tame inflation by pushing borrowing costs higher.

The trajectory of mortgage rates in the coming months is anyone's guess, but predictions are being made. Last week, the Mortgage Bankers Association put out its forecast for where it sees rates heading in the next two years, which included averaging 5% by the end of next year and 4% the following year.

See other articles related to: interest rates, mortgage rate, mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/why_are_mortgage_rates_so_high/21405.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

Only a few large developments are still in the works along 14th Street, a corridor th... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

- A Look At The Tax Benefits of Buying a Home Through a Trust

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- Church Street, U Street + Reeves: A Look At The 14th Street Development Pipeline

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro