Trulia: Buying is 31 Percent Cheaper Than Renting in DC Area

Trulia: Buying is 31 Percent Cheaper Than Renting in DC Area

✉️ Want to forward this article? Click here.

Despite rising home prices, it is still cheaper to buy a home than rent one in the DC area (along with the 100 largest metros in the country), according to a report published today by Trulia.

Trulia determined that buying is 31 percent cheaper than renting in the region, down from 41 percent in favor of buying back in March. However, the real estate site predicts that this gap will only continue to narrow with rising interest rates:

The 30-year fixed rate is now 4.80%, compared with 3.75% one year ago. This jump in rates has raised the cost of buying relative to renting. As a result, buying is 35% cheaper than renting today, versus being 45% cheaper than renting one year ago.

Now with rent-versus-buy analyses, there are always questions about methodology, so Trulia has laid out the step-by-step path they used to come up with rent-vs-buy determinations in metro areas around the country.

In short, Trulia’s team compared the average rent and for-sale prices of an identical set of properties in each city, and then considered the present and future monthly costs associated with buying and renting and factored in one-time costs like down payments and security deposits.

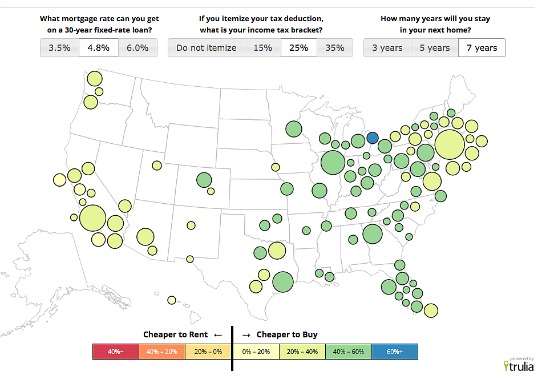

Trulia assumed that owners will have a 4.8 percent rate on a 30-year mortgage and will stay in their homes for seven years. However, they also created an interactive map to see how the numbers work with different assumptions. For example, if someone in the DC-area has a 4.8 percent interest rate on their mortgage, but plans on staying in their home for just five years, buying is 22 percent cheaper than renting. With plans to move after three years, the advantage of buying over renting drops off completely.

If you don’t agree with the assumptions, Trulia has unveiled their own rent-versus-buy calculator, so that users can play around with specific numbers.

See other articles related to: dc rent vs. buy, rent vs buy, rent vs. buy, trulia, trulia trends

This article originally published at https://dc.urbanturf.com/articles/blog/trulia_buying_is_31_percent_cheaper_than_renting_in_dc_area/7578.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

Only a few large developments are still in the works along 14th Street, a corridor th... read »

A soccer stadium in Baltimore; the 101 on smart home cameras; and the epic fail of th... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro