The Rent Versus Buy Debate: A Local Perspective

The Rent Versus Buy Debate: A Local Perspective

✉️ Want to forward this article? Click here.

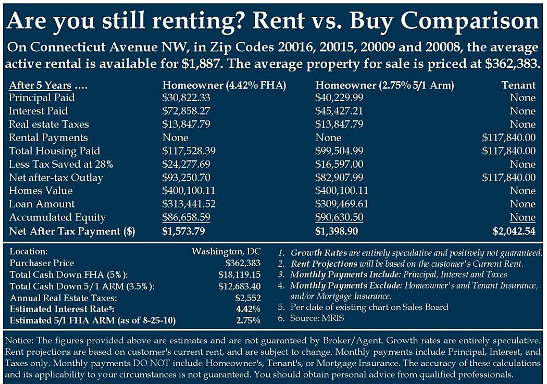

A DC area brokerage recently put together a rent-versus-buy analysis based on rental and home price information of four Northwest DC zip codes. The comparison of tenant versus home owner analyzed the average rental rate ($1,887 a month) against the average property price in 20008, 20009, 20015 and 20016 ($362,383), and projected out what those payments would be over five years. The chart below compares five-year payments on a 4.42 percent FHA loan, a 2.75 percent 5/1 adjustable rate mortgage and total rental payments over five years.

The chart clearly puts forth the idea that with either of the loan options, buying is the better bet to save money and build equity in the long run. While it is important to keep in mind that this is a real estate brokerage putting out this analysis (and that a number of key metrics have been left out), the chart does include disclaimers regarding growth rates and rental projections. Also, conventional financing was not included in the analysis.

However, the big factor here is the growth in value of a home, and despite the fact that the rest of the country’s housing market seems to be down in the doldrums, home prices in the DC area look pretty good these days.

See other articles related to: rent vs buy

This article originally published at https://dc.urbanturf.com/articles/blog/the_rent_versus_buy_debate_a_local_perspective/2423.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

Only a few large developments are still in the works along 14th Street, a corridor th... read »

A soccer stadium in Baltimore; the 101 on smart home cameras; and the epic fail of th... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro