The Difference Between Gross and Net Condo Sales

The Difference Between Gross and Net Condo Sales

✉️ Want to forward this article? Click here.

In a number of UrbanTurf articles about the new condo market, a distinction is made between “gross sales” and “net sales” during a given year. Mark Franceski, Director of Market Research at real estate sales and marketing firm McWilliams|Ballard, explains the difference:

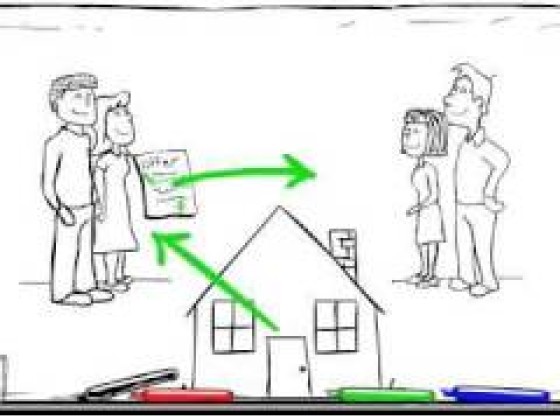

Gross sales are simply all contracts written in a given time period (excluding rescinded contracts, which are treated as if the sale never occurred). Net sales are gross sales minus defaults and cancellations. Defaults are sales that occurred in the years prior to completion of a condo project that do not actually settle when the condo delivers. Cancellations are also sales that occurred prior to construction completion, but which are canceled by the developer in order to convert a building that was originally planned as a condominium into a rental.

Together, defaults and cancellations are “negative net sales” and their subtraction from gross sales leaves us with net sales. There really is no such a thing as a “net sale” in the singular.

McWilliams|Ballard treats gross sales as the best measure of new condo demand in a given year since it is the actual number of sales that occurred (even though some of those sales might become defaults or cancellations in later years).

As an example, imagine Condo X began sales in 2006 when the building broke ground and sold 150 units that year. That is 150 gross sales in 2006. Then, when the building delivered in 2008, 25 of those buyers did not settle because they could no longer afford the mortgage. Another 25 perceived that the value of their condo declined by much more than their deposit, so they decided to forfeit their deposit and default. Those are 50 negative net sales in 2008 that will bring down the net sales figure for that year.

Note that the annual number of negative net sales is cyclical. In recent years there have been a fair number, while in 2010 there will likely be few. That is because most of the condo projects selling this year are already complete and move-in ready, so there isn’t the lag time between signing the contract and settlement during which various factors could cause the buyer to default on the contract. Further out, as preconstruction sales start again in 2011 and 2012, there will likely be a return of negative net sales.

See other articles related to: dc area market trends, dclofts, mcwilliamsballard

This article originally published at https://dc.urbanturf.com/articles/blog/the_difference_between_gross_and_net_condo_sales/1780.

Most Popular... This Week • Last 30 Days • Ever

Plans for the large new residential project are looking to get started again after mo... read »

The Wall Street Journal is reporting that Jeff Skoll has purchased two homes on nine ... read »

The residential pipeline in Adams Morgan has slowed in recent years, and now there ar... read »

Some interesting residential plans are on the boards for the church at 16th Street an... read »

The Sidney features 48 beautifully designed condos, and is one of DC’s only large c... read »

- Plans Filed For 230-Unit Development At Brookland Metro Station

- EBay's First President Buys McLean Homes For $17 Million

- The 4 Developments In The Works In Adams Morgan

- A Nine-Story Condo Building Floated For 16th Street Church Property

- A First Look At The Sidney: 48 Condos Debuting Soon Near Union Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro