North of 7%: The Path of the 30-Year Mortgage Rate Since January

North of 7%: The Path of the 30-Year Mortgage Rate Since January

✉️ Want to forward this article? Click here.

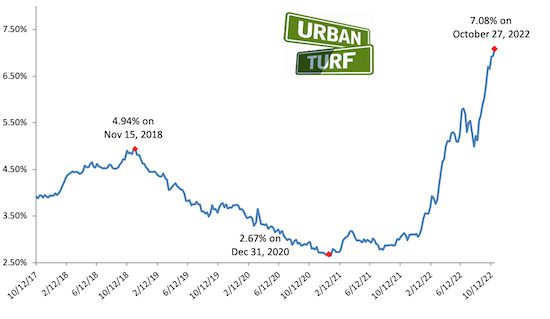

Long-term mortgage rates rose to a level that they haven't seen in decades on Thursday.

Freddie Mac reported 7.08% with an average 0.8 point on a 30-year mortgage this morning. It is the first time that 30-year rates have been above 7% since April 2002.

story continues below

loading...story continues above

“As inflation endures, consumers are seeing higher costs at every turn, causing further declines in consumer confidence this month," said Sam Khater, Freddie Mac’s Chief Economist. "In fact, many potential homebuyers are choosing to wait and see where the housing market will end up, pushing demand and home prices further downward.”

The trajectory of rates upward since the beginning of the year has been historic. Below, UrbanTurf provides a quick timeline of rates since January:

- January 6, 2022 -- 3.22%

- Feburary 17, 2022 -- 3.92%

- March 24, 2022 -- 4.42%

- May 12, 2022 -- 5.30%

- June 23, 2022 -- 5.81%

- August 4, 2022 -- 4.99%

- September 8, 2022 -- 5.89%

- September 29, 2022 -- 6.7%

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

See other articles related to: interest rates, mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/north_of_7_a_timeline_of_the_30-year_mortgage_rate_path_since_january/20248.

Most Popular... This Week • Last 30 Days • Ever

A major new residential development is on the boards for a series of properties near ... read »

A new report from DC’s Office of Revenue Analysis highlights how millennials and wo... read »

The building is the second proposal for a pair of aging office buildings in downtown ... read »

The number of neighborhoods in DC where the median home price hit or exceeded $1 mill... read »

The DC-area housing market hit a sluggish patch in November, according to the latest ... read »

- 29-Story, 420-Unit Development Pitched For Middle Of Downtown Bethesda

- How DC's Population Changed During And After The Pandemic

- Fitting In: A Narrow 260-Unit Apartment Building Pitched For Bethesda

- DC's Record Number Of Million-Dollar Neighborhoods

- An Uncertain November For The DC Area Housing Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro