What's Hot: Cash Remained King In DC Housing Market In 2025 | 220-Unit Affordable Development Planned Near Shaw Metro

Mortgage Demand Drops As Rates Rise

Mortgage Demand Drops As Rates Rise

✉️ Want to forward this article? Click here.

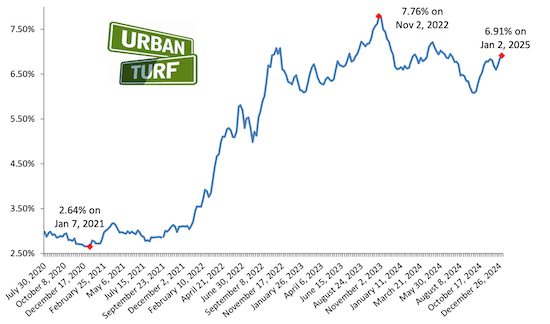

As mortgage rates head back up, demand is dropping to levels not seen since July.

Mortgage application volume dropped 3.7% over the last week, the Mortgage Bankers Association (MBA) reported on Wednesday. Applications to refinance a home actually rose 2% and purchase applications fell 7%, and were 15% lower than a year ago.

“Purchase applications declined for both conventional and government loans and dropped to the slowest weekly pace since February 2024,” said Joel Kan, vice president and deputy chief economist at the MBA. “Refinance applications increased despite higher rates, but the increase was compared to recent low levels and was entirely driven by an increase in VA refinances, which continue to show weekly swings.”

See other articles related to: mortgage demand

This article originally published at https://dc.urbanturf.com/articles/blog/mortgage_demand_drops_as_rates_rise/23061.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

In this week's Under Contract, we highlight two homes that hadn't been on the market ... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro