What's Hot: Amazon To Close Down Fresh Grocery Stores

Lower Mortgage Rates Aren't Bringing Buyers Back...Yet

Lower Mortgage Rates Aren't Bringing Buyers Back...Yet

✉️ Want to forward this article? Click here.

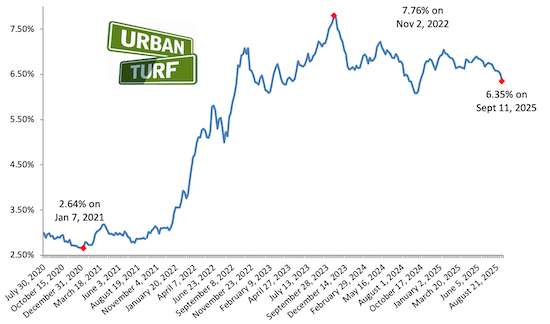

As mortgage rates dropped to their lowest level in nearly a year, refinance demand surged in the last seven days, but buyer demand didn't really follow suit.

Total mortgage volume rose 29% last week, according to the Mortgage Bankers Association (MBA) on Wednesday, largely driven by homeowners refinancing. Applications to refinance a home loan rose 58% compared with the previous week and were 70% higher than the same week one year ago.

“Homeowners with larger loans jumped first, as the average loan size on refinances reached its highest level in the 35-year history of our survey," said Joel Kan, an MBA economist in a release.

Buyers were a little more cautious. Applications to purchase a home rose 3% week-over-week, and were 20% percent higher than a year ago. With a Fed rate cut coming today, it will be interesting to see if buyers' activity picks up after mortgage rates adjust tomorrow.

See other articles related to: mortgage demand, mortgage rates

This article originally published at https://dc.urbanturf.com/articles/blog/lower_mortgage_rates_arent_bringing_buyers_backyet/23872.

Most Popular... This Week • Last 30 Days • Ever

While homeowners must typically appeal by April 1st, new owners can also appeal.... read »

Navy Yard is one of the busiest development neighborhoods in DC.... read »

A significant infill development is taking shape in Arlington, where Caruthers Proper... read »

A residential conversion in Brookland that will include reimagining a former bowling ... read »

After years of experimenting with its branded brick-and-mortar grocery concepts, Amaz... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro