Long-Term Mortgage Rates Fall For First Time Since March

Long-Term Mortgage Rates Fall For First Time Since March

✉️ Want to forward this article? Click here.

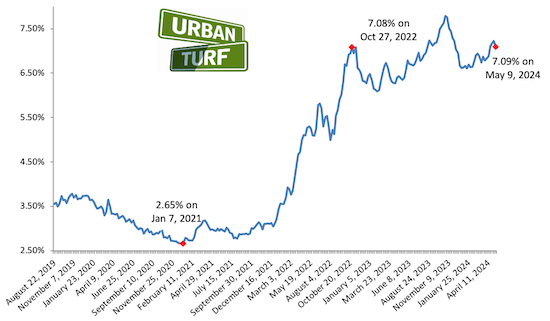

Long-term mortgage rates headed back down for the first time in a couple months on Thursday.

Freddie Mac reported 7.09% as the average on a 30-year mortgage, down 13 basis points from last week. It is the first time since March that rates have decreased.

story continues below

loading...story continues above

“An environment where rates continue to hover above seven percent impacts both sellers and buyers," Sam Khater, Freddie Mac’s Chief Economist, said. "Many potential sellers remain hesitant to list their home and part with lower mortgage rates from years prior, adversely impacting supply and keeping house prices elevated. These elevated house prices add to the overall affordability challenges that potential buyers face in this high-rate environment.”

The UrbanTurf Mortgage Rate Disclaimer: The rates reported by Freddie Mac for 30-year mortgages are usually the best rates that the most qualified borrowers can get, so borrowers or those considering refinancing should not necessarily read this news and think that they can go out and get a loan with the quoted interest rate.

This article originally published at https://dc.urbanturf.com/articles/blog/long-term_mortgage_rates_fall_for_first_time_since_march/22290.

Most Popular... This Week • Last 30 Days • Ever

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

The plans for a building that (forgive us) is just trying to fit in in downtown Bethe... read »

A new proposal is on the boards for the former home of the Transportation Security Ad... read »

The developer is under contract to purchase Land Bay C-West, one of the last unbuilt ... read »

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Narrow 260-Unit Apartment Building Pitched For Bethesda Moves Forward

- 637 Apartments, 31,000 Square Feet Of Retail: The New Plans for Pentagon City TSA Site

- The Last Piece of Potomac Yard: Mill Creek Residential Pitches 398-Unit Apartment Building

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro