IRS Publishes Tax Tips For Home Sellers

IRS Publishes Tax Tips For Home Sellers

✉️ Want to forward this article? Click here.

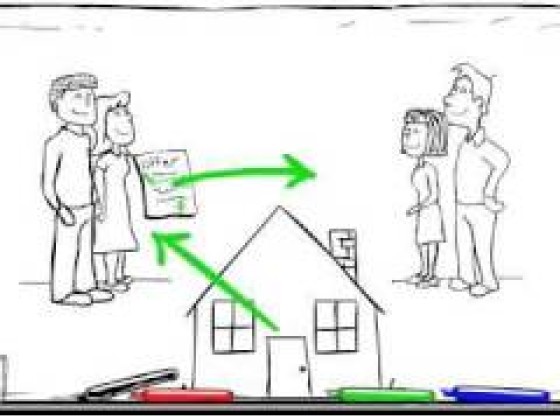

The Internal Revenue Service recently issued a list of tips for individuals who have sold or are about to sell their home. Below are a few that UrbanTurf considered worth highlighting.

- In general, home sellers are eligible to exclude the profit from a home sale from their income if they have owned and used the home as their main residence for two out of the five years prior to the date of its sale.

- Home sellers are not eligible for the above mentioned exclusion if they excluded the gain from the sale of another home during the two-year period prior to the sale of the home.

- Home sellers are not required to report the home sale on their tax return if they are able to exclude the entire gain from the sale.

- A loss can’t be deducted from the sale of your main home.

- If a seller has more than one home, they can exclude a gain only from the sale of their main residence. For the sale of any other home, taxes must be paid on any profit.

Similar Posts:

See other articles related to: home sales, irs, tax tips

This article originally published at https://dc.urbanturf.com/articles/blog/irs_publishes_tax_tips_for_home_sellers/3999.

Most Popular... This Week • Last 30 Days • Ever

In this edition of First-Timer Primer, we look at the ins and outs of the 203k loan.... read »

Plans for the large new residential project are looking to get started again after mo... read »

The Wall Street Journal is reporting that Jeff Skoll has purchased two homes on nine ... read »

The residential pipeline in Adams Morgan has slowed in recent years, and now there ar... read »

Some interesting residential plans are on the boards for the church at 16th Street an... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro