What's Hot: Just Two Townhomes Remain in Phase One of Old Town Alexandria's Newest Luxury Development

How Does Cash-Out Refinancing Work?

How Does Cash-Out Refinancing Work?

✉️ Want to forward this article? Click here.

Today, UrbanTurf takes a closer look at how cash-out refinancing works.

Cash-out refinancing is a financial strategy that allows homeowners to convert a portion of their home's equity into cash. It involves replacing the homeowner's existing mortgage with a new mortgage that has a higher loan amount, and receiving the difference between the two as cash.

If you are considering a cash-out refinancing, the first step is to determine the amount of equity you have in your home. Equity is the difference between your home's current value and the remaining balance on your mortgage. For example, if your home is worth $400,000 and you owe $250,000 on your mortgage, your equity would be $150,000.

story continues below

loading...story continues above

After determining the equity, a homeowner should research and compare different lenders to find the best loan terms for their needs. Factors to consider include interest rates, fees, and closing costs.

The next step is to apply for the new mortgage. This typically involves submitting an application, providing documentation such as income and employment information, and having an appraisal done on your home to determine its value. The lender will use this information to assess your eligibility for the loan and determine the amount you can borrow.

Once the new loan is closed, it will pay off your existing mortgage, and the remaining cash, which is the difference between the new loan amount and the previous mortgage balance, will be disbursed at closing. Some common uses of cash-out refinancing proceeds include home improvements, consolidating high-interest debt, paying for education expenses, or covering unexpected financial needs.

Cash-out refinancing is not without risks. By increasing the loan amount, you'll have a higher mortgage balance and potentially higher monthly payments. Additionally, eligibility requirements for cash-out refinancing may vary depending on factors such as credit score, loan-to-value ratio, and income. Consulting with a financial advisor or mortgage professional can help you make an informed decision based on your specific financial situation.

See other articles related to: cash-out refinacing

This article originally published at https://dc.urbanturf.com/articles/blog/how_does_cash-out_refinancing_work/20940.

Most Popular... This Week • Last 30 Days • Ever

As mortgage rates have more than doubled from their historic lows over the last coupl... read »

Rocket Companies is taking a page from the Super Bowl advertising playbook with a spl... read »

An incredibly rare opportunity to own an extraordinary Maryland waterfront property, ... read »

The large-scale residential development will head to before the Montgomery County Dev... read »

Leading the way is the 20015 zip code where almost half of homeowners are considered ... read »

- What is an Assumable Mortgage?

- The Super Bowl Ad That Will Give Away A Million-Dollar Home

- 28 Acres, 1,500 Feet of Potomac River Waterfront: Sprawling Estate Hits The Market Just South of DC

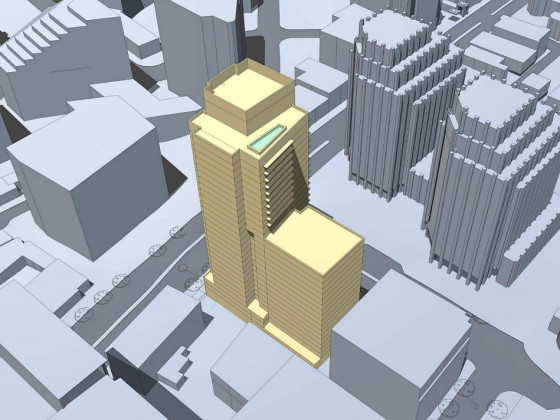

- 29-Story, 420-Unit Development Pitched For Bethesda Moves Forward

- New Report Looks At Where Owners Are House Rich In DC

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro