Home Price Watch: Prices Rise 20% in Bloomingdale

Home Price Watch: Prices Rise 20% in Bloomingdale

✉️ Want to forward this article? Click here.

Rowhouses in Bloomingdale.

Last week UrbanTurf began using new data from RealEstate Business Intelligence (RBI) to look at the real estate market in specific DC area neighborhoods. First up was Capitol Hill, where low inventory made for lower sales volume and rising prices.

This week we take a look at data specific to the Bloomingdale neighborhood. It should be noted that Bloomingdale covers a much smaller area than Capitol Hill, which means that a 50 percent increase in sales year-over-year translates to 15 homes selling so far in 2014, compared to ten at this time last year.

Bloomingdale is roughly bounded by Michigan Avenue to the north, Florida Avenue to the south, 2nd Street to the west, and North Capitol Street to the east.

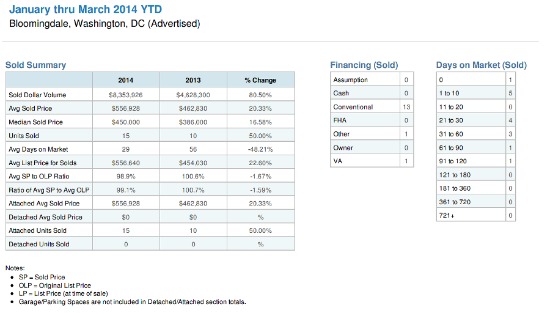

Data from the 2014 RBI report for Bloomingdale reveals that the neighborhood housing market is quite hot compared to last year. Here are some highlights:

- Sales volume went up dramatically in Bloomingdale in 2014. Total home sales so far this year come in at $8.4 million, compared to about $4.6 million last year, an 80 percent increase. As noted above, 15 homes have sold so far in 2014 versus ten at this point last year.

- The average sales price in the neighborhood rose to $556,928 in 2014 from $462,830 last year, a 20 percent increase. The median sales price also rose by approximately 15 percent.

- The average time that homes spent on the market dropped from 56 days in 2013 to 29 days in 2014.

- As on Capitol Hill, sellers believe they can get more for their homes this year, as list prices rose 22 percent.

See other articles related to: bloomingdale, home price watch, home prices

This article originally published at https://dc.urbanturf.com/articles/blog/home_price_watch_bloomingdale/8383.

Most Popular... This Week • Last 30 Days • Ever

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

While condo fees are often predictable, there are instances when they may need to be ... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

One of the most ambitious federal housing proposals in years is moving through the le... read »

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- How Do Condo Buildings Determine When Condo Fees Need to Be Increased

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

- What Is In The Big New Housing Bill?

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro