First-Timer Primer: How to Buy a House at Auction

First-Timer Primer: How to Buy a House at Auction

✉️ Want to forward this article? Click here.

Below, UrbanTurf put together a quick primer on the ins and outs of a home auction.

What is a home auction?

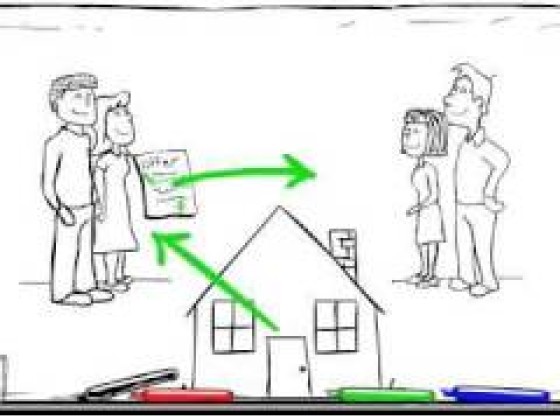

A home auction is another means of dispensing of a property. While many auctions can be the result of financial hardship or foreclosure (or other "involuntary" sales), "voluntary" auctions are those initiated by the owners of the property, making them more analogous to a traditional home sold through a brokerage.

What differentiates the auction process from the traditional homebuying process?

In a voluntary auction, all prospective buyers are agreeing to the terms of a sale, found in the property's purchase agreement, before the bidding commences. The terms of these sales typically include the property being sold as-is and without contingencies for financing, inspection and the like. In a traditional home sale, each prospective buyer submits an offer to the seller and can either include terms in that offer or not; the seller and buyer then agree to terms for an offer to be accepted.

story continues below

loading...story continues above

A few other important things about an auction

- Properties may be auctioned with a minimum reserve price attached, where the home cannot sell for any less than a certain amount.

- In many cases, you can inspect the property before you bid.

- The auction itself can take place at the property, online, or some combination of the two.

- Auction bidders are often required to present a cashier's check or complete a wire transfer for the property deposit prior to participating in the auction. Many auction houses also charge a buyer's premium, which would be the equivalent of broker fees.

- You can use financing to purchase a house via auction.

- If a renter lives in the property at the time of the auction, you must still honor their lease.

- You don't need to use an agent to purchase via auction, but you will need a title company to perform the title transfer, and it would be wise to do research or get advice before bidding to make sure you have an idea of what comparable properties are selling for and that you feel comfortable with bidding.

It is wise to look at the particulars of a listing's preliminary agreement and auction terms before deciding to bid. This is even more important when it comes to involuntary auctions triggered by foreclosure or other issues, as these often come with more stipulations and will require a judicial review after the bidding is complete in order to secure the title.

Note: Much of the information provided above pertains to Alex Cooper Auctioneers, which is one of the largest auction houses in the area by volume of transactions. There may be some differences depending on who is administering the auction.

See other articles related to: auctions, first-timer primer, homebuying

This article originally published at https://dc.urbanturf.com/articles/blog/first-timer-primer-how-to-buy-a-house-at-auction/16457.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf takes a look at the distinct differences between these two popular f... read »

The largest residential conversion planned in the neighborhood is continuing to move ... read »

DC restaurant Pascual makes national best new restaurant list; Minetta Tavern is abou... read »

Despite it being a slower year for the housing market in the DC area, there are two B... read »

The rising fees that come with homeownership; Virginia toll road costs RV driver near... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro