What's Hot: The 4 Projects in the Works Near DC's Starburst Intersection | A 153-Room Aloft Hotel Pitched For Mt. Vernon Triangle

Fall Predictions: DC Area Home Prices to Rise Just 1-2 Percent this Fall

Fall Predictions: DC Area Home Prices to Rise Just 1-2 Percent this Fall

As fall approaches, there are a number of questions floating around about the DC area housing market. Will inventory continue to come online making it a buyer’s market? Will the slew of new apartments entering the rental market push rents down? Will mortgage rates head higher as experts have predicted?

With these questions in mind, UrbanTurf will be hearing the predictions and trends that local industry professionals believe will play out in the fall market.

DC Area Home Prices to Rise Just 1-2 Percent this Fall

By Corey Hart and Jonathan Hill, RealEstate Business Intelligence

Following several years of impressive home price gains, new listing activity in the DC area picked up considerably in the first half of 2014, a welcome trend for buyers following the exceedingly competitive market of last year. The influx of new listings, coupled with softer sales, had a cooling effect on the unsustainable year-over-year price gain trends of the recent past. So far in 2014, the median sales price of $410,000 in the region is only 1.2 percent higher than the same period in 2013.

Even with nominal year-over-year gains, the year-to-date median sales price matched the previous high set in 2006. If the 10 percent price gains seen in 2013 had continued into 2014, then we’d likely have seen an even sharper contraction in closed sales as more potential buyers would have been priced out of the market. Even with moderate price gains, the dearth of affordable inventory and a lagging local job market (stemming largely from Federal job cuts) have contributed to a five percent decrease in sales. Home prices have remained resilient in the face of supply-and-demand winds shifting away from sellers as the market undergoes some normalization, and that should be of relief to area homeowners.

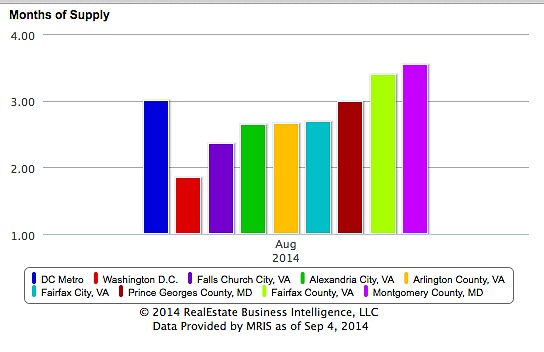

On the heels of new listings increasing in 16 of the last 17 months and eight straight months with fewer sales than the prior year, active inventory in the metro area is now a third higher than last year at this time. While still a seller’s market, this represents three months of supply compared to only 2.2 months of supply at this point last year. As listings are taking longer to sell, more sellers may consider lowering aggressive asking prices or accepting lower offers during home sale transactions this fall. Given that the market is shifting toward more balance and that home prices are at or near all-time highs in most counties in the DC area, we expect the median sales price this fall to only grow 1 to 2 percent compared to last year.

At a county/city level, Prince George’s County and Washington, DC are two places that we anticipate will outpace the modest price growth we’re predicting for the region, but for two very different reasons.

The relative affordability in Prince George’s County lends itself to larger price gains. The year-to-date median sales price in Prince George’s is $219,999, 46 percent lower than the region overall. Home prices in the county are only two-thirds of their 2006 peak, so even though the supply picture there is similar to that of the region (3 months of supply), we expect the county to lead the region in year-over-year price gains, with gains of 10-12 percent compared to last fall, driven by its relative affordability compared to its neighbors and the distance between current prices and its ceiling.

Price appreciation in DC proper won’t match the year-over-year price gains of neighboring Prince George’s County. The year-to-date median sales price of $499,700 is 4.3 percent higher than the $479,000 mark in 2013 and a remarkable 19 percent higher than the previous peak of $420,000 in 2006. Even though prices are at peak levels in the District, we anticipate 3-to-5 percent year-over-year price gains to continue into the fall. Why will price gains in DC proper outpace the region? Supply and demand: Active inventory in DC is only 7 percent higher than this time last year and, more importantly, the city had only 1.9 months of supply at the current sales pace.

Obviously there will many other exceptions at the zip code and subdivision level – it’s important to take any regional pricing predictions with a grain of salt. Even though prices in DC area expected to rise 3-to-5 percent, there will be areas (like Logan Circle and Anacostia) that will see double-digit price gains continue into the fall. Anyone considering buying or selling a home should pay close attention to the hyper-local market conditions.

See more real estate predictions for fall:

- Apartment Vacancies Rise With Rents Dropping in 2015

- Mortgage Rates Will Remain Flat for Rest of 2014

- Watch the Inventory

This article originally published at https://dc.urbanturf.com/articles/blog/fall_predictions_dc_area_home_prices_to_rise_just_1_2_percent_this_fall/8964.

Most Popular... This Week • Last 30 Days • Ever

In this article, UrbanTurf looks at the estimated annual maintenance costs associated... read »

Another concept has been unveiled for one of DC's most contentious development sites,... read »

The residential development in the works along Florida Avenue NE is looking to increa... read »

Renter demand has continued to push Class A apartment rents in the DC region up this ... read »

The big news in the development pipeline east of DC's H Street Corridor is the resur... read »

- What Are the Annual Maintenance Costs When You Own a Home?

- A First Look At The New Plans For Adams Morgan's SunTrust Plaza

- 46 to 48: The Biggest Project In Trinidad Looks To Get Bigger

- How Much Did DC-Area Rents Rise At The Beginning of 2024?

- The 4 Projects In The Works Near DC's Starburst Intersection

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro