What's Hot: A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

DC Area Rents Drop As New Supply Hits Market

DC Area Rents Drop As New Supply Hits Market

✉️ Want to forward this article? Click here.

Rendering of apartment building lobby at Monroe Street Market.

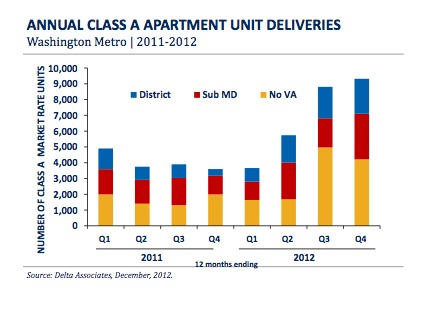

The ever-growing supply of new apartments in the DC area seems to finally be catching up with demand. After years of increasing, rents are now dropping in many parts of the region.

A Delta Associates report out Wednesday analyzing the regional market in the fourth quarter of 2012 states that rents for Class A apartments (large buildings built after 1991, with full amenity packages) in the region rose 1.9 percent during the prior year, compared to an increase of 2.4 percent in 2011. While still rising region-wide, the report reveals that rents in many sub-sections of the region are now falling, after showing double-digit annual gains last quarter.

For example, Class A rents in the NoMa/H Street area fell 4.7 percent, after reporting 14.1 percent gains in the prior quarter. And in the upper NW sub-market, rents dropped about 1 percent after rising 13.7 percent in the third quarter of 2012. Rents did not fall everywhere, however. Capitol Riverfront (3.9%) and the sub-market that includes Penn Quarter, Logan Circle and Dupont Circle (2.5%) showed rent increases.

Courtesy of Delta Associates

Here is a quick snapshot of average rents for Class A apartments in DC area sub-markets, as defined by Delta:

- Central: (Penn Quarter, Logan Circle, Dupont Circle, etc.) $2,780 a month

- Upper Northwest: $2,605 a month

- Columbia Heights/Shaw: $2,514 a month

- NoMa/H Street: $2,337 a month

- Capitol Riverfront: $2,212 a month

- Alexandria/Arlington: $1,840 a month

- Rockville/North Bethesda: $1,942 a month

There are a number of reasons that rents are now falling, but primarily it is due to high levels of new supply and a pipeline that now seems oversized compared with demand. For loyal UrbanTurf readers this should not come as surprise. Back in April, we reported that the delivery of new apartment projects (and resulting increase in vacancies) will put downward pressure on rents in the region by the end of the year. It appears that is just what has happened.

The report released today looked at Class A apartment projects. Next week, UrbanTurf will take a closer look at the state of the Class B market.

Definitions:

- Class A apartments are typically large buildings built after 1991, with full amenity packages. Class B buildings are generally older buildings that have been renovated and/or have more limited amenity packages.

See other articles related to: apartments, dc apartments, delta associates, renting, renting in dc

This article originally published at https://dc.urbanturf.com/articles/blog/dc_apartment_rents_drop_as_new_supply_hits_market/6497.

Most Popular... This Week • Last 30 Days • Ever

On Thursday night, developer EYA outlined its plans at a community meeting for the 26... read »

EYA and JM Zell Partners have plans for 184 townhomes and 336 apartments spread acros... read »

Today, UrbanTurf is taking our annual look at the trajectory of home prices in the DC... read »

Chris Hughes and husband Sean Eldridge are putting their Kalorama home on the market ... read »

If the walls of 1222 28th Street NW could talk, they'd have nearly three centuries wo... read »

- A First Look At Friendship Commons, The Big Plans To Redevelop Former GEICO Headquarters

- 520 Residences Planned For Former GEICO Campus In Friendship Heights

- The 10-Year Trajectory Of DC-Area Home Prices In 4 Charts

- Facebook Co-founder Lists DC Home For Sale

- One of DC's Oldest Homes Is Hitting the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro