What's Hot: What Is In The Big New Housing Bill?

10 Percent Down and No PMI -- BB&T's 80/10/10 Loan

10 Percent Down and No PMI -- BB&T's 80/10/10 Loan

✉️ Want to forward this article? Click here.

BB&T’s 80/10/10 loan is one of the best financing options for homeowners who only have 10 percent to put toward a down payment, are looking to buy homes priced up to $900,000, and don't want to pay mortgage insurance.

The mortgage product actually consists of two separate loans: 80 percent of the home's purchase price is financed as a first mortgage, and 10 percent as a second mortgage. The last "10" in the loan's name refers to the down payment required. Splitting the loans -- the first mortgage at 80 percent and a second at 10 percent -- eliminates the need for mortgage insurance.

The interest rate on the 80 percent mortgage is normally in the range of current long-term rates, while the second loan carries a slightly higher rate. One of the advantages of the BB&T option is that it offers rates on second loans that are notably lower than its competitors. As of today, BB&T can do a second 30-year trust at approximately 5.0 percent.

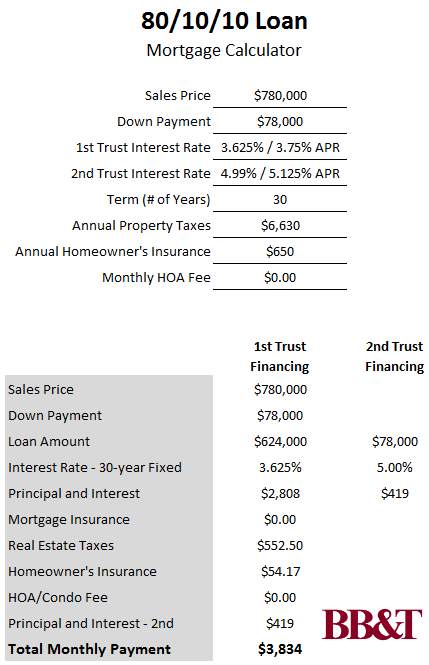

Below is a breakdown on a $780,000 home purchase using an 80/10/10 loan:

BB&T's 80/10/10 Loan

"In markets like this, the 80/10/10 loan is a great option for homeowners who can't or don’t want to put 20 percent down," BB&T mortgage loan officer Kevin Connelly said. "We help a lot of borrowers who are looking to buy a house in the $450,000-$900,000 price range with these loans."

Here is a quick rundown of specifics and eligibility qualifications for the loan product:

- Borrowers who use 80/10/10 can receive loan amounts on homes priced up to $900,000.

- Borrowers must have a credit score of at least 720.

- The loan product is available just for townhome and single-family home purchases.

- The loan is not available to first-time buyers.

- Borrowers must have at least six months of reserves in checking, savings, stocks, or retirement accounts.

For more information about the 80/10/10 loan, click here or contact Kevin Connelly at 703-855-7403 or via email at KConnelly@BBandT.com.

See other articles related to: bb&t, mortgages, sponsored articles

This article originally published at https://dc.urbanturf.com/articles/blog/bbts_80_10_10_loan/6762.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

A new proposal is on the boards for the former home of the Transportation Security Ad... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- 637 Apartments, 31,000 Square Feet Of Retail: The New Plans for Pentagon City TSA Site

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro