What's Hot: Cash Remained King In DC Housing Market In 2025 | 220-Unit Affordable Development Planned Near Shaw Metro

As Fixed Rate Mortgages Rise, ARMs See Demand

As Fixed Rate Mortgages Rise, ARMs See Demand

✉️ Want to forward this article? Click here.

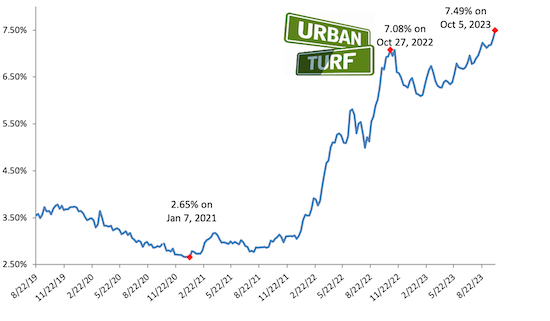

As long-term mortgage rates reach heights not seen in 20 years, adjustable rate mortgages are seeing renewed interest.

The Mortgage Bankers Association (MBA) reported Wednesday that mortgage application volume rose slightly this week, thanks to an increase in adjustable rate mortgages (ARMs).

story continues below

loading...story continues above

The increase is the result of the widening difference between 30-year rates and adjustable rates. As long-term rates rose to 7.67%, adjustable rates fell to 6.33%.

"The level of ARM applications increased by 15 percent over the week, bringing the ARM share up to 9.2 percent of all applications, the highest since November 2022," Joel Kan, MBA’s Vice President and Deputy Chief Economist, said in a release. "The yield curve has become less inverted in recent weeks and ARM pricing has certainly improved."

See other articles related to: adjustable rate mortgages, mortgage bankers association

This article originally published at https://dc.urbanturf.com/articles/blog/as_fixed_rate_mortgages_rise_arms_see_demand/21566.

Most Popular... This Week • Last 30 Days • Ever

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

A report out today finds early signs that the spring could be a busy market.... read »

A potential collapse on 14th Street; Zuckerberg pays big in Florida; and how the mark... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro