What Could the Fiscal Cliff Mean to DC-Area Homeowners?

What Could the Fiscal Cliff Mean to DC-Area Homeowners?

✉️ Want to forward this article? Click here.

As the holidays approach, the Obama administration and Congress are in the midst of heated negotiations regarding the impending fiscal cliff. One of the many items on the table for discussion is the mortgage interest deduction, a policy that benefits homeowners but may be in danger of being eliminated.

The mortgage interest deduction incentivizes home ownership by lowering an individual’s tax burden: homeowners can deduct any interest paid on their mortgage, often a significant amount, from their taxable income. Some believe that taking away the deduction would hurt the economy by causing home prices to fall. The Obama administration has been in favor of capping the mortgage interest deduction on high-income households. (Mitt Romney was in favor of capping all itemized tax deductions).

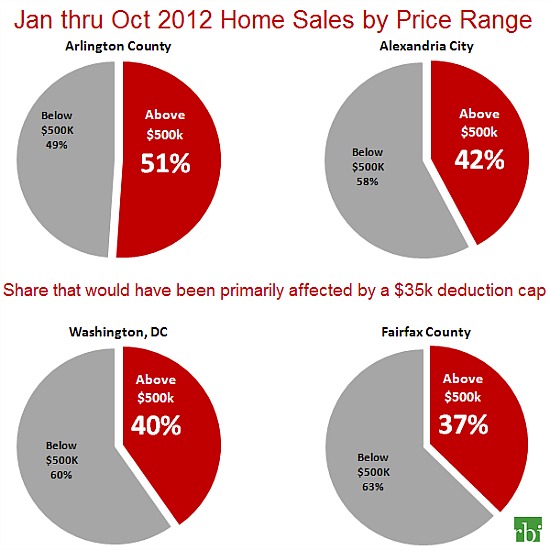

Recently, RealEstate Business Intelligence (RBI) took a look at how many homes sold in the area so far this year would be impacted by a $35,000 mortgage interest deduction cap. See a breakdown (those affected by the cap in red) in the charts below:

Courtesy of RealEstate Business Intelligence

RBI cited this analysis from Econ 70 regarding limiting the deduction:

“If all 1040-Schedule A deductions, including the mortgage interest deduction are capped at about $35,000, then homeowners with houses priced north of $500,000 would be the ones primarily affected, and their homes would fall in value. Interestingly, they might respond by reducing charitable giving. If, however, the deductible amount is limited to 80% of total deductions, then all itemizers would be hurt, and many more houses would decline in price.”

See other articles related to: fiscal cliff, mortgage interest deduction

This article originally published at https://dc.urbanturf.com/articles/blog/what_could_the_fiscal_cliff_mean_to_homeowners/6405.

Most Popular... This Week • Last 30 Days • Ever

New data shows that it was the most robust year on record for high-priced home sales ... read »

The mortgage interest deduction allows homeowners who itemize their taxes to reduce t... read »

Georgetown is one of the busiest neighborhoods for development in the city.... read »

The large-scale residential development will head to before the Montgomery County Dev... read »

Leading the way is the 20015 zip code where almost half of homeowners are considered ... read »

- $2.5 Million And Up...And Up: Luxury Home Sales Set Record In DC Area In 2025

- How Does The Mortgage Interest Deduction Work?

- Hotels, Heating Plants & Conversions: The 10 Big Projects In The Works In Georgetown

- 29-Story, 420-Unit Development Pitched For Bethesda Moves Forward

- New Report Looks At Where Owners Are House Rich In DC

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro