What's Hot: Cash Remained King In DC Housing Market In 2025 | 220-Unit Affordable Development Planned Near Shaw Metro

Was 2021 The Strongest Year Ever for the DC Apartment Market?

Was 2021 The Strongest Year Ever for the DC Apartment Market?

✉️ Want to forward this article? Click here.

Several signs point to DC having its strongest rental market on record in 2021.

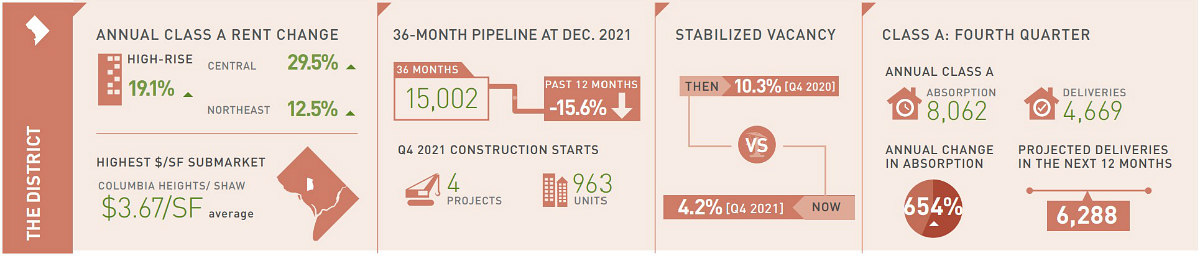

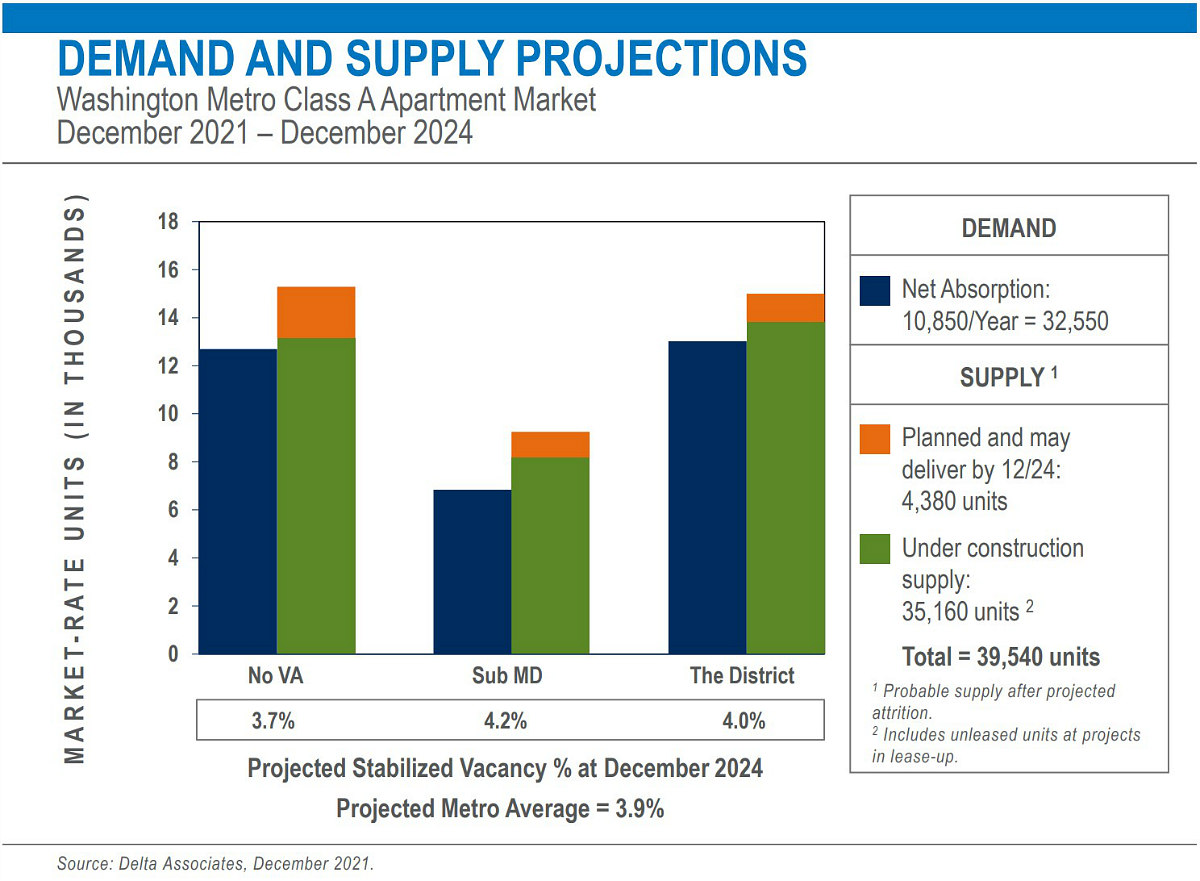

Apartment absorption increased by a whopping 654% in DC proper last year, according to the latest quarterly report from Delta Associates, with more than 8,000 apartments leased in the city. These absorptions not only accounted for almost half of all apartments absorbed in the DC metro area in 2021, but it was also the first year that over 8,000 units were absorbed in the city.

story continues below

loading...story continues above

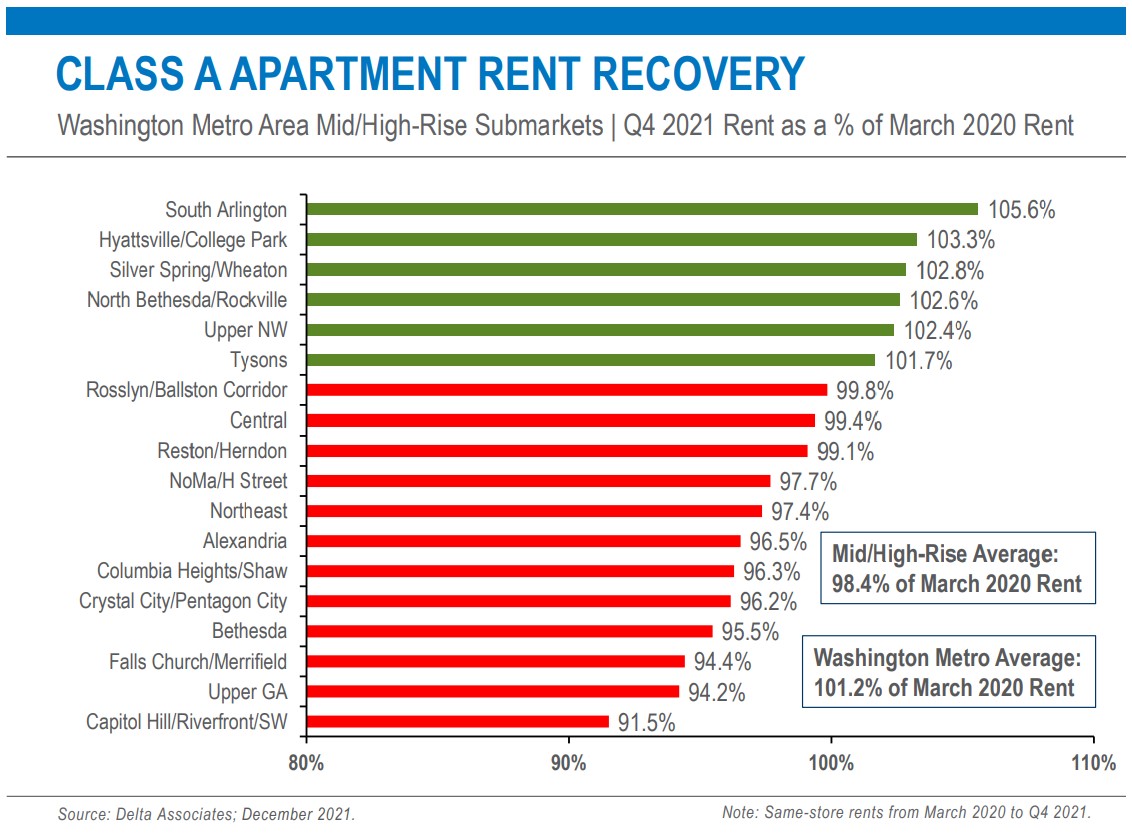

Consequently, rents rose by 19% in the city last year, although the average rent remains at 97% of pre-pandemic levels. Metrowide, Class A apartment rents were up by 15% last year, compared to a 10.2% drop in 2020.

In Northern Virginia, absorption rose by 68% last year, led by high-rises in the Rosslyn/Ballston Corridor. In the fourth quarter of 2021, average rents in Northern Virginia were at 102.3% of rent levels in March 2020. Meanwhile, annual absorption rose by 129% in Suburban Maryland, led by high-rises in Bethesda (617 units absorbed, 1,006 units delivered). Fourth quarter rents in the submarket were at 104% of March 2020 levels.

Rent growth was the highest areawide last year in Central DC (Penn Quarter, Logan Circle),where rents rose almost 30% year-over-year; the Columbia Heights/Shaw submarket came in second with rents rising 18%. The Capitol Hill/Capitol Riverfront/Southwest submarket led both the city and the area in absorption, its 3,936 leased units exceeding the total absorption in all of Suburban Maryland. The NoMa/H Street submarket led the region in the number of units delivered last year (1,945), although apartment deliveries were down by 21% across DC.

Here is a quick snapshot of average rents for high-rise Class A apartments in DC area sub-markets, as defined by Delta:

- Alexandria: $2,213 per month

- Bethesda: $2,792 per month

- Capitol Hill/Capitol Riverfront: $2,570 per month

- Central (Penn Quarter, Logan Circle, Dupont Circle, etc.): $2,923 per month

- Columbia Heights/Shaw: $2,619 per month

- Crystal City/Pentagon City: $2,452 per month

- Hyattsville/College Park: $1,962 per month

- NoMa/H Street: $2,341 per month

- Northeast: $2,075 per month

- Rosslyn-Ballston Corridor: $2,580 per month

- Silver Spring/Wheaton: $2,038 per month

- Upper Northwest: $2,989 per month

Note: The rents are an average of studios, one and two-bedroom rental rates at Class A high-rise buildings in the DC area in Q4 2021.

Definitions:

Class A apartments are typically large buildings built after 1991, with full amenity packages.

See other articles related to: class a apartments, dc apartments, dc area rental market, dc rental market, delta associates

This article originally published at https://dc.urbanturf.com/articles/blog/was-2021-the-strongest-year-ever-for-the-dc-apartment-market/19177.

Most Popular... This Week • Last 30 Days • Ever

Today, UrbanTurf is taking a look at the tax benefits associated with buying a home t... read »

Lincoln-Westmoreland Housing is moving forward with plans to replace an aging Shaw af... read »

The small handful of projects in the pipeline are either moving full steam ahead, get... read »

A potential innovation district in Arlington; an LA coffee chain to DC; and the end o... read »

A soccer stadium in Baltimore; the 101 on smart home cameras; and the epic fail of th... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro