Trulia: Buying Still Outweighs Renting in DC Area

Trulia: Buying Still Outweighs Renting in DC Area

✉️ Want to forward this article? Click here.

It is still cheaper to buy a home than rent one in DC (along with 98 out of 100 major Metros in the U.S.), according to a report published today by real estate search website Trulia.

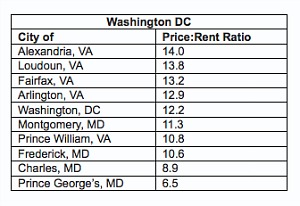

Trulia’s Rent vs. Buy Index, which launched in June 2010, calculates the price-to-rent ratio using the median list price for two-bedroom properties compared with the median rent for two-bedroom apartments, condos and townhomes listed on its site. The index uses a rule of 15, which means that if the median list price divided by the annual median rent produces a score of 15 or less, the city is considered a good place to buy. While any score below 15 indicates that it is better to buy than rent, the lower the number, the better to buy.

Courtesy of Trulia Trends.

Trulia sent UrbanTurf some DC-area specific stats, breaking down the region into the city proper and the surrounding suburbs, and every area has a score that falls below the 15 point rent-buy threshold. DC proper has a score of 12.2 (down slightly from a score of 14 last year), while Alexandria tops the list at 14, just barely making it better to buy. Housing prices in Prince George’s, MD gave them the best score in the area at 6.5. Nationally, San Francisco, Honolulu and parts of New York City (Manhattan, Staten Island, Brooklyn) are the only major cities where Trulia deemed it is better to rent than to buy; on the other end of the spectrum, Detroit had a score of just 3.7.

“As rents rise and prices stagnate, homeownership is becoming even more affordable, but rising rents create a dilemma for people who can’t afford to buy yet,” said Jed Kolko, Trulia’s Chief Economist. “Rising rents make it harder for people to save for a down payment, which is the biggest barrier to buying a home that aspiring homeowners face.”

While the index does provide some perspective on the rent versus buy debate, an individual’s decision as to whether they will buy a home requires taking a number of variables into account (property taxes, down payment, interest rates) for the total cost of ownership, a point that Trulia acknowledges.

“We created the index to determine which cities have overpriced rent and which have underpriced,” Daisy Kong of Trulia told UrbanTurf last year. “The decision to buy a home is a very personal one and the index should just be used as a guide in that process.”

To see Trulia’s full post and interactive graphic, click here. For Kolko’s in-depth commentary on the topic in Atlantic Cities, click here.

See other articles related to: dclofts, editors choice, home buying, home prices, rent vs buy, trulia, trulia trends

This article originally published at https://dc.urbanturf.com/articles/blog/trulia_still_better_to_buy_than_rent_in_dc/5311.

Most Popular... This Week • Last 30 Days • Ever

Priced from $1.2 million, the 108 stately brownstones and 17 single-family homes will... read »

In this edition of First-Timer Primer, we look at the ins and outs of the 203k loan.... read »

Today, UrbanTurf takes a look at the distinct differences between these two popular f... read »

The largest residential conversion planned in the neighborhood is continuing to move ... read »

Despite it being a slower year for the housing market in the DC area, there are two B... read »

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro