A $500 Premium? The Value of Walkability

A $500 Premium? The Value of Walkability

✉️ Want to forward this article? Click here.

Downtown DC by Shay Thomason

Expanding on the finding that more walkable neighborhoods have higher home prices, a new study released by the Brookings Institution takes a look at exactly how the numbers break down.

Brookings ranked neighborhoods around DC using a scoring system that took into account features like connectivity, density, proximity of uses and traffic measures. It then separated the neighborhoods into five levels of walkability. According to the report, a jump up to the next level of walkability (from Wheaton to Adams Morgan, for example) can yield significant increases in housing prices and rents. It concluded that the most walkable neighborhoods in the area are Georgetown and Courthouse and the least are along sections of New York Avenue and Naylor Road.

From the report:

A one-level (or approximately 20 pt) increase in walkability translates into a $8.88 value premium in office rents, a $6.92 premium in retail rents, an 80 percent increase in retail sales, a $301.76/square foot premium in residential rents, and a $81.54/square foot premium in residential housing values.

Courtesy of Brookings.

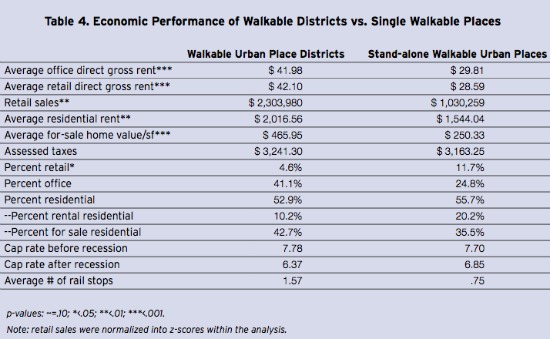

The report concluded that it’s also valuable to be clustered near other walkable neighborhoods. Compared to standalone walkable areas, the clustered neighborhoods commanded nearly 41 percent more in office rents, 47 percent more in retail rents, and nearly 31 percent more in residential rents. The chart above shows that there is about a $500 difference in the average rents between standalone walkable areas and those that are clustered.

All of this points to a shift in preferences that UrbanTurf has been seeing for some time: suburbs are out, and walkable urban centers are in. Also, prices are high because of a supply/demand problem: more people want to live in walkable neighborhoods than the current housing inventory allows.

People talk about this shift all the time, but the authors of this report are hoping that by attaching real numbers to the economic benefits of living and setting up shop in a walkable neighborhood, policy makers and developers will be able to move quickly to create the kinds of neighborhoods people want to live in.

See other articles related to: brookings institution, walkability, walkable

This article originally published at https://dc.urbanturf.com/articles/blog/the_value_of_walkability/5587.

Most Popular... This Week • Last 30 Days • Ever

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

While condo fees are often predictable, there are instances when they may need to be ... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

On Thursday, the Zoning Commission will consider text amendments aimed at making it e... read »

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- How Do Condo Buildings Determine When Condo Fees Need to Be Increased

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

- The Decision That Could Lead To More Alley Homes In DC May Be Coming Next Week

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro