The Buying vs. Renting Equation is Changing

The Buying vs. Renting Equation is Changing

✉️ Want to forward this article? Click here.

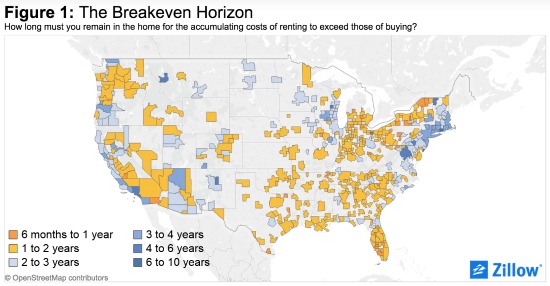

The time it takes for buying a home to become a more financially sound decision than renting is getting longer, according to Zillow.

The “breakeven” point, where the start-up expenses related to buying a house, along with equity gains, make renting a net loss, is getting further out from the time of move-in. In the DC area, for example, Zillow says it now takes four years and two months for buying to make more sense than renting. DC’s breakeven horizon is the second-longest for a metro area in the country, behind only Los Angeles (five years).

The breakeven point is getting longer, Zillow notes, because the rise in home values is slowing. Stable rents have played a role, too:

In many markets, including those mentioned above with lengthening Horizons, expectations for slower home value growth going forward are driving the changes. Slower home value growth means it will take longer for growing equity to offset the often substantial costs of purchasing and owning a home, including closing costs, property taxes, maintenance and renovations, and insurance. … In some areas, rents have become cheaper relative to home values, so local Breakeven Horizons have lengthened, making renting seem like a better option – even, in some cases, despite stronger forecasts for home value growth.

Here are the stats Zillow has on the DC metro area:

- Median breakeven horizon: 4.2 years

- Median price-to-rent ratio: 14.6 — (The ratio of home prices to rents)

- Expected home value appreciation in year 1: 1.38%

- Expected annual rent inflation in year 1: 0.73%

- Expected long-term home value appreciation: 3.35%

- Expected long-term rent inflation: 2.89%

In DC proper, the horizon goes out even further:

- Median breakeven horizon: 4.7 years

- Median price-to-rent ratio: 16.2

- Expected home value appreciation in year 1: 2.03%

- Expected annual rent inflation in year 1: 2.15%

- Expected long-term home value appreciation: 3.35%

- Expected long-term rent inflation: 2.89%

And in Arlington, you’ll have to plan to stay even longer for renting to make sense:

- Median breakeven horizon: 6.6 years

- Median price-to-rent ratio: 18.2

- Expected home value appreciation year 1: 0.74%

- Expected annual rent inflation in year 1: 1.39%

- Expected long-term home value appreciation: 3.35%

- Expected long-term rent inflation: 2.89%

See other articles related to: breakeven horizon, rent vs. buy, zillow

This article originally published at https://dc.urbanturf.com/articles/blog/the_buying_vs._renting_equation_is_changing/9739.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

Taicoon Property Partners will take its plans for a seven-story, 88-unit luxury condo... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

Even with a handful of projects being nixed over the last year, there are still a num... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Plans For One Of Northern Virginia's Largest Condo Projects Move Forward

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

- The 6 Big Residential Projects In The Works Around National Landing

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro