Changes to BB&T's CHIP Loan, The FHA Alternative

Changes to BB&T's CHIP Loan, The FHA Alternative

✉️ Want to forward this article? Click here.

BB&T’s Community Homeownership Incentive Program, better known as CHIP, is one of the best alternatives to FHA financing available on the market today. Recently, however, a number of changes were made to the income and credit score requirements for the popular loan option.

In short, CHIP offers qualifying home buyers up to 100% financing with no private mortgage insurance in stable and increasing value markets. The lack of private mortgage insurance means that the monthly payments on a CHIP loan are often lower than those on competing FHA loans.

Borrowers who use CHIP can receive loan amounts up to $417,000. All CHIP loans are 30-year fixed and borrowers must contribute at least $500 toward the loan. While the CHIP loan does not require you to be a first-time buyer, you can not own any other real estate at the time of closing. Owner occupancy is required on the home being purchased, and the property appraisal has to come back saying that the market where the property is located is stable.

Here is a rundown of the recent changes to income and credit score requirements for CHIP, provided by BB&T Mortgage Loan Officer Kevin Connelly:

- Within the DC MSA (metropolitan statistical area), the maximum income for 100% financing is $84,000.

- In order to qualify for 100% financing, the borrower must now have a minimum credit score of 680.

- In order to qualify for 97% financing, the borrower must have a minimum credit score of 620.

In order to make sure that borrowers are qualified, Connelly said that the bank does a complete manual underwrite. The borrower is required to provide two months of pay stubs, two months of bank statements, and two years of W-2 forms. In addition, borrowers are required to attend a homebuyer education course.

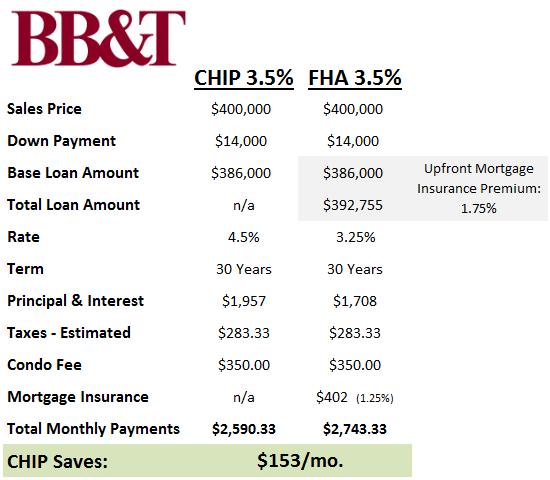

Here is a side-by-side comparison of how CHIP monthly loan payments compare to FHA payments on a $400,000 condo purchase with 3.5% down:

CHIP versus FHA

For more information about the Community Homeownership Incentive Program in the DC area, click here or contact Kevin Connelly at 703-855-7403 or via email at KConnelly@BBandT.com.

See other articles related to: bb&t, dclofts, mortgages, sponsored articles

This article originally published at https://dc.urbanturf.com/articles/blog/sponsored_changes_to_bbts_chip_loan_the_fha_alternative/6734.

Most Popular... This Week • Last 30 Days • Ever

While it may seem like paying off a long-term mortgage early is a difficult task, it ... read »

The property in Upperville known as Ayrshire Farm sold on Friday.... read »

A new proposal is on the boards for the former home of the Transportation Security Ad... read »

The developer is under contract to purchase Land Bay C-West, one of the last unbuilt ... read »

The classic Federal-style home recently underwent a dazzling, $2M renovation and boas... read »

- A Look at The Ways You Can Pay Off Your Mortgage Early

- Sandy Lerner's 570-Acre Virginia Farm Sells For $19.8 Million

- 637 Apartments, 31,000 Square Feet Of Retail: The New Plans for Pentagon City TSA Site

- The Last Piece of Potomac Yard: Mill Creek Residential Pitches 398-Unit Apartment Building

- A Pool, Elevator and Glass Roof: Luxuriously Renovated Georgetown Home Hits the Market

DC Real Estate Guides

Short guides to navigating the DC-area real estate market

We've collected all our helpful guides for buying, selling and renting in and around Washington, DC in one place. Start browsing below!

First-Timer Primers

Intro guides for first-time home buyers

Unique Spaces

Awesome and unusual real estate from across the DC Metro